Markets can be dramatic. In India’s history, major shocks have sometimes triggered panic selling – only for calm and confidence to return shortly after. Whether it was a surprise Budget or a global crisis, Dalal Street has often shown its resilience. In this post, we tell five stories of sudden stock market drops and equally sudden recoveries – a true “stock market bounce back.” We set the stage for each event, explain the panicky sell-off, and then show how investors regrouped in the days or weeks that followed.

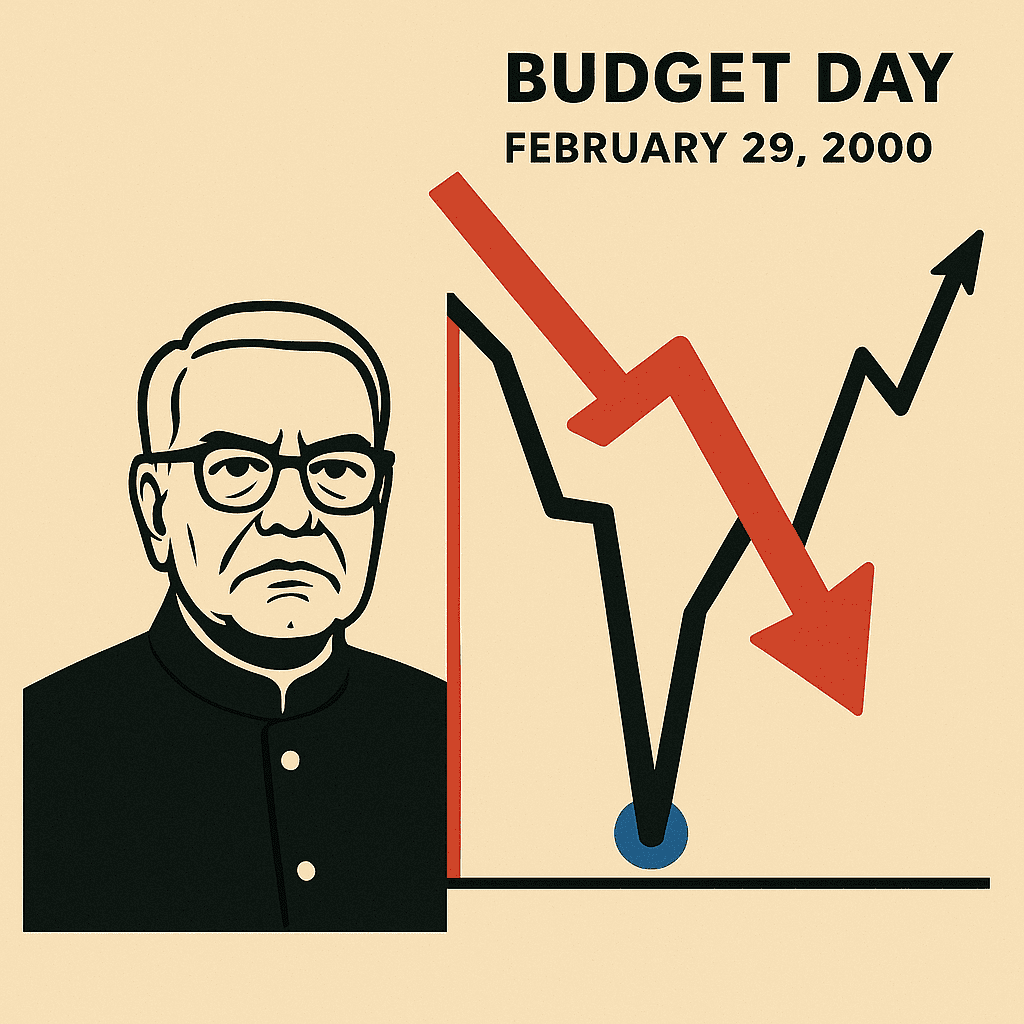

Budget Crash (Feb 2000)

It was Budget Day 2000, and Finance Minister Yashwant Sinha had promised a “tough” fiscal plan. As traders poured into offices on Feb 29, the nightmarish scenario they feared came true: new taxes on dividends and exports. Stocks turned red almost immediately. The BSE Sensex plunged ~350 points intraday, eventually closing about 294 points down on the day.

The sudden sting of the budget announcements sparked panic: brokers saw LTB investors selling in droves and water-cooler chatter turned grim. But the fright did not last. By the next few trading sessions, buyers stepped in. Investors realized that many budget measures were long-term fixes (and that foreign inflows were still upbeat). Confidence crept back. Within a week or two, the Sensex had regained most of its loss, riding on bargain-hunting and optimism about India’s growth. In effect, the budget-inspired drop turned out to be a brief wobble before stocks marched upward again – a classic stock market bounce back on Dalal Street.

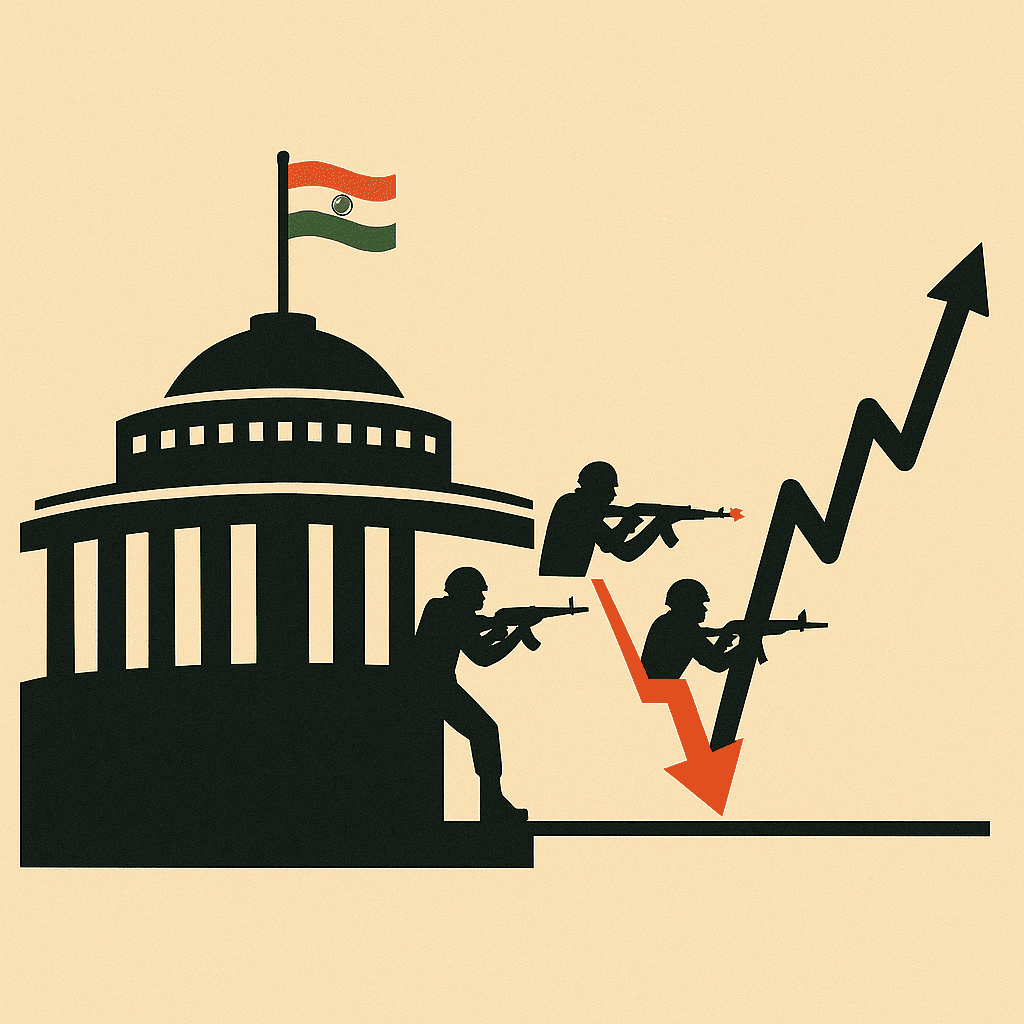

Parliament Attack (Dec 2001)

The next shock was entirely different in nature. On the afternoon of Dec 13, 2001, news broke that terrorists had attacked the Indian Parliament in New Delhi. The mood turned to fear. The Sensex, which had opened around 3,412, tumbled by ~100 points immediately after the news.

The screen of the trading hall flickered red as traders rushed to sell, worried that India might be on the brink of a war. Yet this panic proved very short-lived. By evening, news filtered through that security forces had contained the attack and there would be no wider assault. Traders breathed a sigh of relief. In fact, after the initial dive, the market recovered 50 points in 10 minutes and then traded sideways as the danger passed.

By the close, the Sensex was only 24 points down on the day – roughly 0.7%, far from a crash.

In other words, on Dec 13 itself the market nearly snapped back to even. The story did not end there. In the days that followed, as India’s military stand-down started, bearish sentiment faded.

Investors gradually returned, viewing the storm as over. The indexes recovered fully to pre-attack levels within a week. In hindsight, the Parliament attack triggered only a blip of selling; the Indian market “bounced back” almost immediately once the panic subsided.

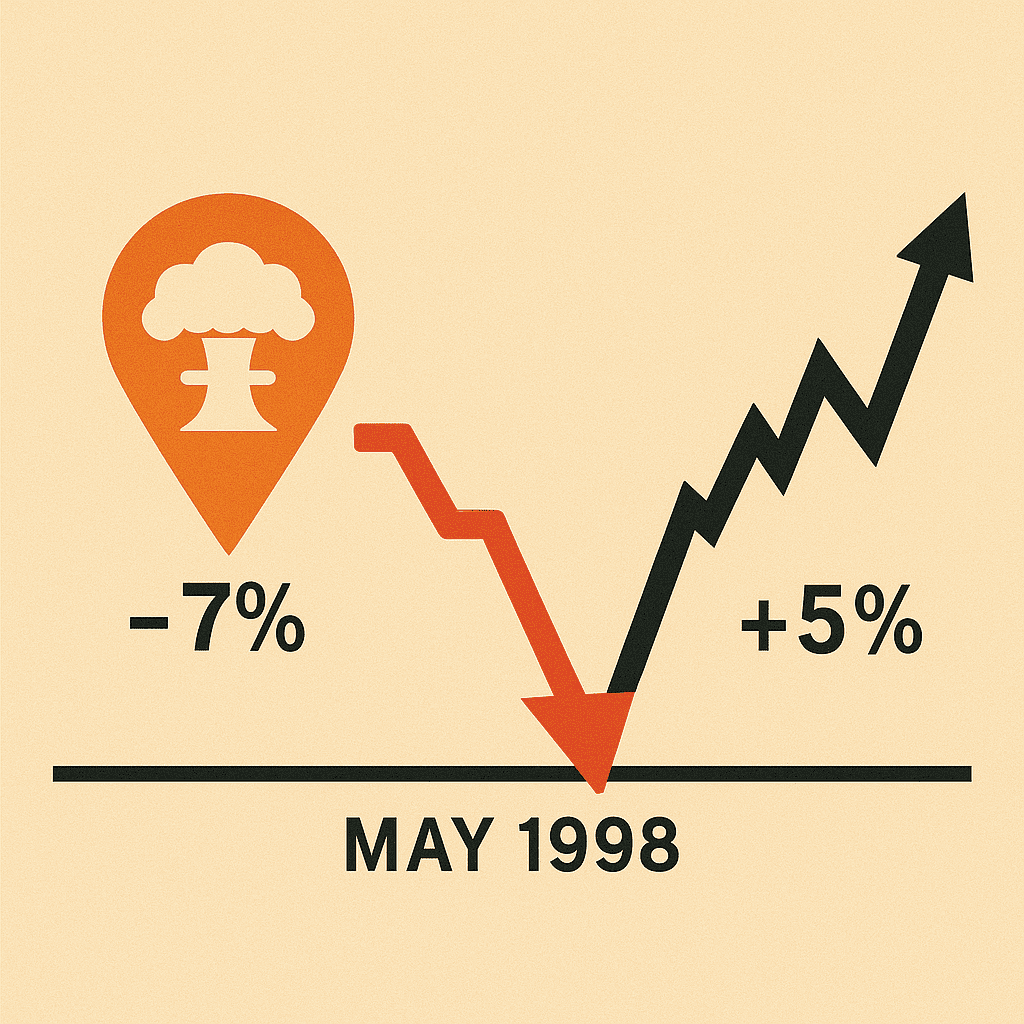

India’s Nuclear Tests (May 1998)

In May 1998 India conducted a series of underground nuclear tests at Pokhran (Pokhran-II). International response was swift: many countries announced sanctions and threatened financial pressure. On the stock charts, the tests spooked traders. Between May 11 and May 13 (the dates of the blasts), the Sensex slid about 7% as foreign investors feared economic fallout and domestic money rushed into perceived safe havens. Then came the reversal. Within just a few days after May 13, markets rallied. According to data from that time, the Sensex recovered roughly 5% in the three trading sessions after the sell-off.

In practical terms, investors realized that India’s economy was fundamentally sound: sanctions were short-term and markets soon priced in the changed status quo. Bulls swooped in to buy beaten-down blue-chips, treating the dip as a buying opportunity. The Pokhran episode shows how even a geopolitical shock of that scale led only to a brief correction.

Once the political drama settled, confidence returned – a textbook stock market bounce back. By late May the Sensex was already heading north again, and India’s GDP continued growing without long-term disruption.

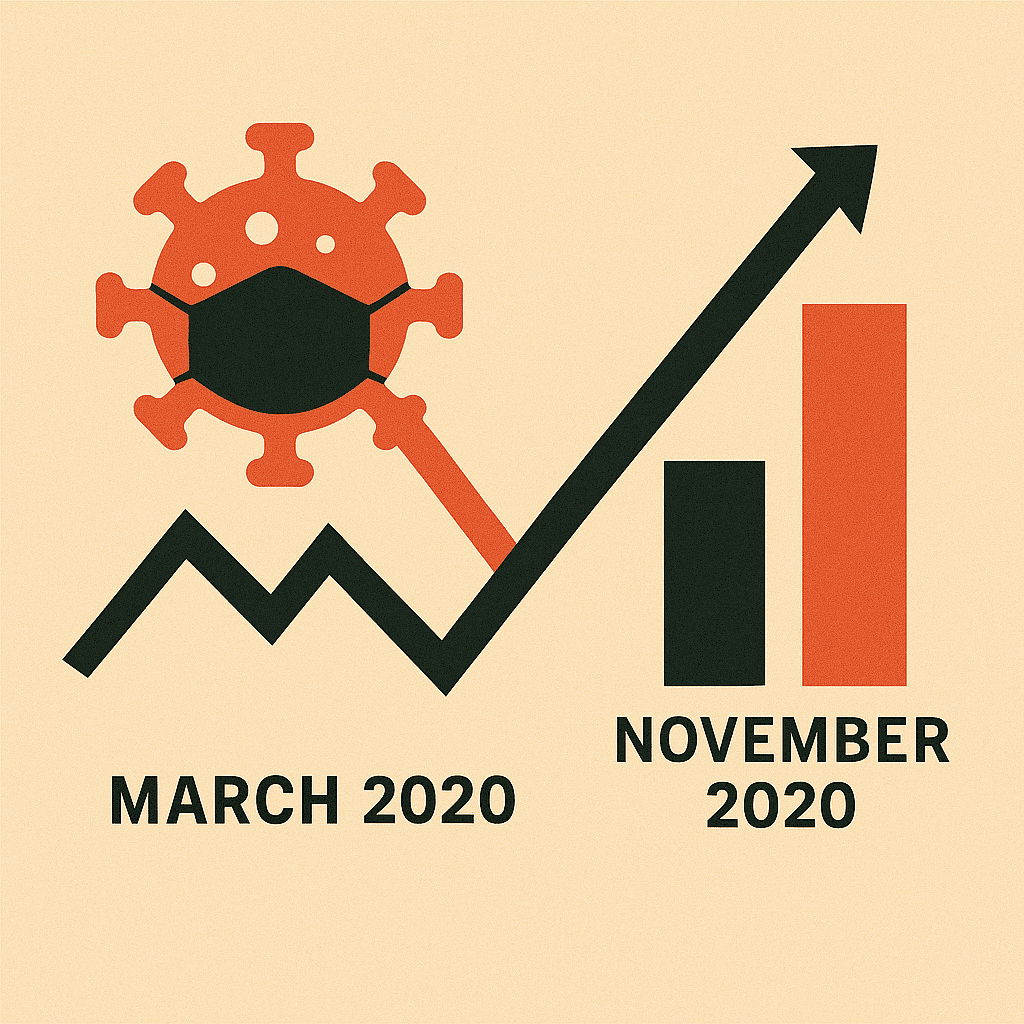

Covid Crash (March 2020)

Fast forward to 2020: a virus turned global panic into a market meltdown. In mid-March, India imposed one of the world’s strictest lockdowns to fight COVID-19. On March 23, 2020 the BSE Sensex plunged 3,934 points (13.15%) in a single day – a near-crash as fear of pandemic lockdowns gripped the world. The daily loss wiped out months of gains. Newspaper headlines screamed about the biggest rout since the 2008 crisis. Yet even this plunge was temporary. Central banks around the globe (and the RBI in India) unleashed massive stimulus. By late 2020 the turnaround was astonishing. In fact, the Sensex quickly shot back up. According to Business Standard, after hitting a low of around 25,981 in late March 2020, the index rallied 58% over the next eight months. By November 2020 it had climbed all the way back to about 41,000 – essentially erasing the crash losses.

What caused the rebound? Investors concluded that

(1) government aid was buying time,

(2) future growth would eventually resume, and

(3) valuations were too low to ignore.

Hospitals and health news gave hope of a solution. Gradually, retail and foreign buyers poured into the market on every good headline. The result was a swift “V-shaped” recovery – one of the fastest stock market bounce backs on record, all within the same year that saw the crash.

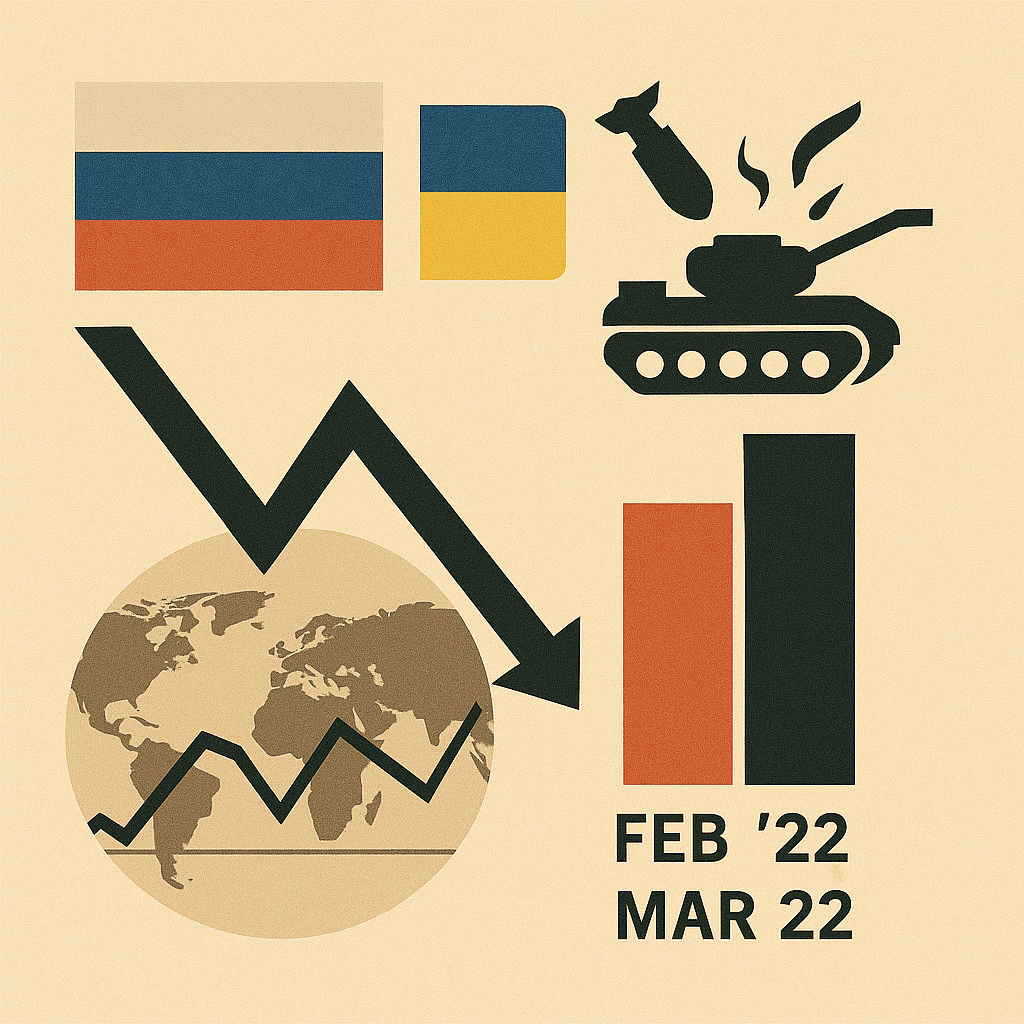

Russia–Ukraine War (Feb 2022)

The most recent scare came from Europe. When Russia invaded Ukraine on Feb 24, 2022, global markets tumbled on fears of war and inflation. In India, the Sensex fell about 2,800 points (roughly 4.7%) on that day alone.

This drop was one of the steepest in two years, as oil prices spiked and uncertainty reigned. Headlines touted one of the worst starts to a year on Dalal Street. But, echoing the earlier examples, the crash proved short. By the end of March 2022 India’s markets were already recovering. In fact, the BSE index jumped 4.1% in March 2022 despite the lingering war news.

The turnaround continued through the fiscal year: the Sensex ended FY2022 up about 18% overall.

How? Investors eventually saw that India’s economy was relatively insulated, oil supplies stabilized, and diplomatic talks (or at least de-escalation hope) set in. In less than a month, fear gave way to buying.

Fund managers re-entered beaten-down sectors (like banks and infra), and retail investors returned as volatility indicators cooled. By April 2022, much of the Russia-Ukraine selloff had been recovered. Once again, what looked like a devastating plunge ended up as a brief setback. The stock market bounce back was on full display: India’s equity market shrugged off a geopolitical crisis faster than many expected.

These 5 crashes proved one thing: the Indian market knows how to bounce back.

Want to stay ahead in investing? Get expert trading insights with our AI-powered platform. WhatsApp us today!