Markets have a way of whispering opportunities to those who know how to listen. Right now, the Sensex is doing just that. If you’ve been on the fence about investing, you might want to pay attention—this could be the chance you’ve been waiting for. The Sensex, India’s premier stock market index, is currently trading at valuation levels that haven’t been seen in nearly a decade. But let’s not rush into conclusions—let’s explore why this moment holds such promise for long-term investors.

A Time of Rare Valuation Levels

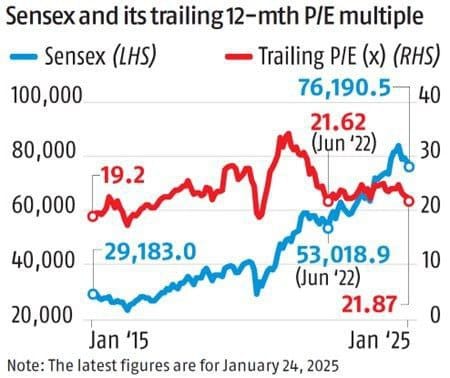

In the world of investing, valuation is a critical compass. It helps us navigate whether stocks are overvalued, undervalued, or just right. Currently, the Price-to-Earnings (P/E) ratio of the Sensex stands at 21.9, which is significantly below its 10-year average of 24.1. In simpler terms, the market is offering a better bang for your buck.

Warren Buffett, the Oracle of Omaha, once said, “Price is what you pay, value is what you get.” Right now, the Sensex is offering tremendous value compared to its historical trends.

Why it matters:

- Lower P/E ratios indicate that stocks are cheaper relative to their earnings.

- Historically, periods of low valuation have often preceded long-term market upswings.

But don’t just take the P/E ratio at face value; there’s more to this story.

Earnings Growth Speaks Volumes

When it comes to investing, earnings are the lifeblood of a company’s value. Here’s where things get really interesting: companies within the Sensex have reported a robust 19.2% growth in Earnings Per Share (EPS), rising from ₹2,921.5 to ₹3,483.8. This means that while stock prices have remained relatively subdued, the actual earnings of these companies have grown substantially.

This disparity creates what some might call a “sweet spot” for long-term investors. As the saying goes,

“The stock market is a device for transferring money from the impatient to the patient.”

And right now, patience could be richly rewarded.

Why This Moment is Unique

For the seasoned investor, moments like this don’t come often. A combination of lower valuations and strong earnings growth is a cocktail of potential that can lead to outsized returns. But, of course, no investment comes without risks.

Here’s why this opportunity shines:

- Reduced Risk: Lower valuations mean you’re entering the market with less downside.

- High Reward Potential: Strong earnings growth hints at a brighter future.

A Few Words of Caution

As tempting as this opportunity may seem, let’s not forget the unpredictable nature of markets. Economic, geopolitical, and global financial trends can still throw a wrench into even the most well-thought-out plans. Short-term volatility is always a possibility, so it’s crucial to stay grounded.

The Art of Risk-Reward Balance

Benjamin Graham, the father of value investing, once remarked, “The essence of investment management is the management of risks, not the management of returns.” This wisdom is particularly relevant in today’s market.

How to manage risk effectively:

- Diversify your portfolio to spread risk.

- Avoid chasing hot trends and focus on quality stocks.

- Consider adopting a dollar-cost averaging strategy, investing a fixed amount periodically to reduce the impact of market volatility.

Where to Look: Sector-Specific Opportunities

Not all sectors are created equal, and some industries are shining brighter than others. Here are a few sectors to keep on your radar:

- Technology: With innovation and digital transformation at its core, tech stocks often promise long-term growth.

- Banking: With strong earnings and economic recovery, banks are poised for robust performance.

- Manufacturing: India’s push toward becoming a global manufacturing hub makes this sector an exciting prospect.

When evaluating sectors, dig into their P/E ratios and earnings growth metrics to identify the best opportunities.

The Bigger Picture: Macroeconomic Trends

India’s economic fundamentals remain strong, with robust GDP growth and supportive government policies acting as tailwinds. But global conditions, including interest rate trends and inflation, will also play a critical role. Investors should stay informed and agile to navigate these dynamics effectively.

Key Takeaways for Investors

If you’re a long-term investor, here’s how you can position yourself to make the most of the current scenario:

- Identify Quality Stocks: Look for companies with strong fundamentals and consistent earnings growth.

- Adopt Dollar-Cost Averaging: Invest small, fixed amounts periodically to reduce risk.

- Stay Diversified: Spread your investments across sectors and asset classes.

- Keep Learning: Stay informed about economic trends and market developments.

As you navigate this promising yet unpredictable terrain, remember the words of Peter Lynch:

“Know what you own, and know why you own it.”

With thorough research, patience, and a clear strategy, this moment in the Sensex could become a defining chapter in your investment journey.

So, are you ready to seize this golden opportunity?

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Investors are encouraged to perform their own analysis and seek professional guidance before making investment decisions.

Q7 Trading Solutions pioneers in algorithmic trading with tailored strategies for Stock options and Index options. Harnessing the power of AI and Big Data, we deliver precision in technical analysis using statistics & mathematical modeling, providing a reliable path to optimize trading outcomes. You can learn more about its prowess by joining our 28k+ strong community absolutely for FREE.