RBI monetary policy committee decides on the change of Repo rate, which directly impacts the market. Increasing the interest rate will reduce the money flow and demand in the market, curbing inflation. Similarly, if demand is low in the market, RBI decreases the interest, thus making loans cheaper to boost consumption and subsequently higher demand.

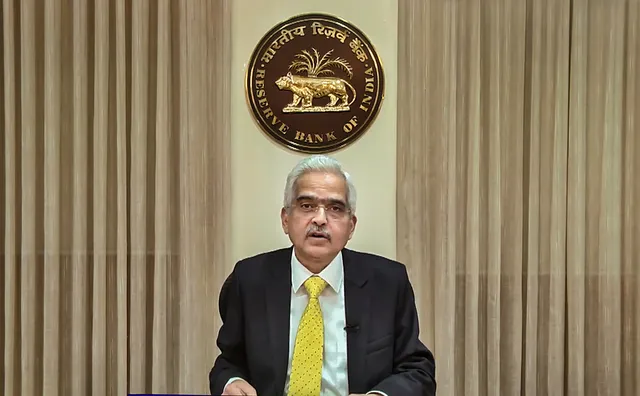

Now, let’s come to the 9th June MPC meeting. MPC will remain vigilant and take further policy action as required to keep inflation expectations anchored and bring inflation down to 4%. Headline inflation will remain above 4% in FY24, MPC decides to remain focussed on withdrawal of accommodation of policy stance: RBI Governor.

Rbi gov says real GDP growth seen at 6.5% for FY24. Indian economy and financial sector stand strong and resilient. Domestic macroeconomic activities are moderating. Forex reserves are comfortable. Credit growth is robust. RBI maintains its repo rate unchanged at 6.50%

Present inflation and factors impacting it:

1. Cpi Inflation Seen At 5.1% for FY24

2. Geopolitical tensions, international commodity prices, and global financial market volatility pose upside risks to inflation 10-YR bond yield rises marginally by 2bps to 7% from the previous day’s close of 6.98%

In a nutshell,

👉 Rate unchanged 6.5%

👉 Financial sector in India strong

👉 Geopolitical issues still there

👉 Inflation moderated

👉 Forex comfortable, credit growth robust

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Investors are encouraged to perform their own analysis and seek professional guidance before making investment decisions.

Q7 Trading Solutions pioneers in algorithmic trading with tailored strategies for Stock options and Index options. Harnessing the power of AI and Big Data, we deliver precision in technical analysis using statistics & mathematical modeling, providing a reliable path to optimize trading outcomes. You can learn more about its prowess by joining our 28k+ strong community absolutely for FREE.