The Indian financial services landscape is witnessing a revolutionary shift with the formation of a joint venture (JV) between Jio Financial Services and BlackRock, the world’s largest asset management company. This collaboration combines Jio’s expansive digital network with BlackRock’s unmatched expertise in global investment management. Together, they aim to offer a wide range of digital financial services and democratize investment opportunities for millions of Indian citizens.

This article breaks down the Jio BlackRock JV, explores the future plans of this strategic partnership, and provides a full Jio Financials and BlackRock merger update that will impact traders, stock market investors, and everyday consumers.

Jio Financial Services and BlackRock Merger: What You Need to Know

In July 2023, Jio Financial Services (JFSL) and BlackRock announced their joint venture, each investing $150 million for a total of $300 million to create a platform that caters to the growing demand for digital financial solutions in India. The venture received approval from India’s Securities and Exchange Board (SEBI), marking a significant milestone.

The Jio Financials and BlackRock merger focuses on three primary objectives:

- Innovative Financial Products: The JV plans to roll out mutual funds, ETFs (Exchange-Traded Funds), and wealth management services, targeting both tech-savvy investors and first-time users.

- Technology-Driven Services: Utilizing artificial intelligence (AI) and machine learning (ML), the platform aims to offer personalized investment advice and streamlined digital financial services.

- Expanding Financial Literacy: The venture aims to improve financial literacy in India, empowering users to make well-informed investment decisions.

Together, the companies will harness Jio’s massive user base of 450 million customers and BlackRock’s global investment expertise, managing over $10 trillion in assets.

Why the Jio BlackRock JV Matters

The Indian mutual fund industry is expanding at an astonishing rate. With assets under management reaching ₹53.40 lakh crore by March 2024—a 35.46% year-over-year increase—Jio and BlackRock see immense potential in tapping into this market. The JV aims to introduce cutting-edge investment solutions tailored to meet the diverse financial needs of India’s young and digitally savvy population.

Jio Financial Services (formerly Reliance Strategic Investments) has already made waves in India’s fintech ecosystem, while BlackRock’s presence in India spans over 17 years. Combining their strengths, this venture could democratize access to wealth creation for millions of Indians, particularly those underserved by traditional financial institutions.

5 Key Benefits of the Jio BlackRock JV for Indian Investors

- Accessible Investment Products: The venture will introduce a wide array of financial products, from mutual funds to ETFs, offering investment options for all risk profiles.

- Personalized Financial Services: By integrating AI and ML, users can expect more tailored investment advice that aligns with their financial goals.

- Cost-Efficient Solutions: With a focus on digital-first services, this partnership could lower operational costs, making investment products more affordable for the average Indian.

- Financial Inclusion: The JV’s emphasis on financial literacy and easy-to-use digital platforms aims to bring more Indians into the formal investment market, encouraging savings and wealth creation.

- Sustainable Investing: The JV will also offer products aligned with Environmental, Social, and Governance (ESG) principles, catering to investors interested in responsible investing.

Valuation Projections

Analysts estimate that HDBFin’s valuation could range between ₹15,000 crore to ₹20,000 crore, based on comparative analysis with other leading NBFCs like Bajaj Finance and Muthoot Finance. This valuation reflects the company’s solid fundamentals and growth potential.

Investor sentiment remains optimistic, buoyed by the broader recovery of the financial sector post-pandemic and the anticipated continued demand for consumer financing. Institutional investors, in particular, have shown considerable interest, as evidenced by the confidence displayed during pre-IPO roadshows.

Challenges Ahead for Jio Financial Services and BlackRock

Despite the potential, the Jio BlackRock JV faces several challenges:

- Complex Regulatory Landscape: Navigating India’s stringent financial regulations will require careful planning and compliance efforts.

- Fierce Competition: India’s fintech market is crowded, with both startups and established players vying for dominance.

- Cultural Shift to Digital Investments: While urban areas are rapidly adopting digital financial products, rural and semi-urban regions still face hurdles in digital literacy. The JV will need to address these gaps to succeed.

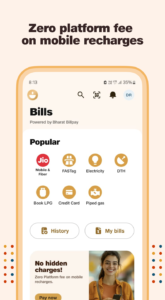

JioFinance App: Expanding Digital Financial Services

The JioFinance app is a core part of Jio Financial Services’ strategy to enhance access to financial services. Launched alongside the joint venture, this app is already creating waves, with over 1 million downloads within its first week.

Key features of the JioFinance app include:- Instant Loans: Users can quickly access personal loans and financing for electronics like smartphones.

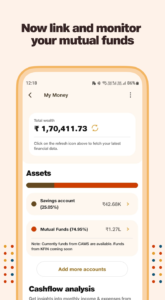

- Investment Options: The app will soon add features for investing in mutual funds and other financial products.

- Digital KYC: Users can complete their KYC process online in minutes.

- 24/7 Access: With its easy-to-use interface available in 15 Indian languages, the app is designed to make financial services more inclusive and accessible.

Looking ahead, the app is expected to expand its features to become a one-stop shop for all financial needs, adding new services based on user feedback.

Future Outlook and Market Impact

The Jio BlackRock JV is expected to increase competition in the mutual fund space, likely pushing other financial service providers to enhance their digital offerings. With Jio’s vast reach and BlackRock’s deep investment expertise, this collaboration could reshape how Indians engage with financial products.

The venture could also spur innovation in low-cost index funds and ETFs, making them accessible to millions of Indians. This digital-first approach aligns with global trends and may help increase mutual fund penetration in the country.

Conclusion: A New Era for India’s Financial Services

The Jio BlackRock JV has the potential to revolutionize the way Indians access financial services. By combining Jio’s extensive digital infrastructure and BlackRock’s world-class investment capabilities, this partnership promises innovative, affordable, and accessible solutions for investors across India. For those looking to invest in mutual funds or diversify their portfolio, the collaboration between Jio Financial Services and BlackRock could offer new opportunities to build wealth.

As the digital financial landscape evolves, keep an eye on the Jio Financials and BlackRock merger update to stay informed about future developments and opportunities in the Indian market.

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Investors are encouraged to perform their own analysis and seek professional guidance before making investment decisions.

Q7 Trading Solutions pioneers in algorithmic trading with tailored strategies for Stock options and Index options. Harnessing the power of AI and Big Data, we deliver precision in technical analysis using statistics & mathematical modeling, providing a reliable path to optimize trading outcomes. You can learn more about its prowess by joining our 28k+ strong community absolutely for FREE.