Hey there! If you’ve been wondering whether to invest in an IPO (Initial Public Offering) or stick with buying regular stocks, you’re not alone. This is one of the most common questions among new investors. But don’t worry—I’m here to help you understand both options, their pros and cons, and which one might be better for you.

Let’s break it down step by step, like how I’d explain it to a friend.

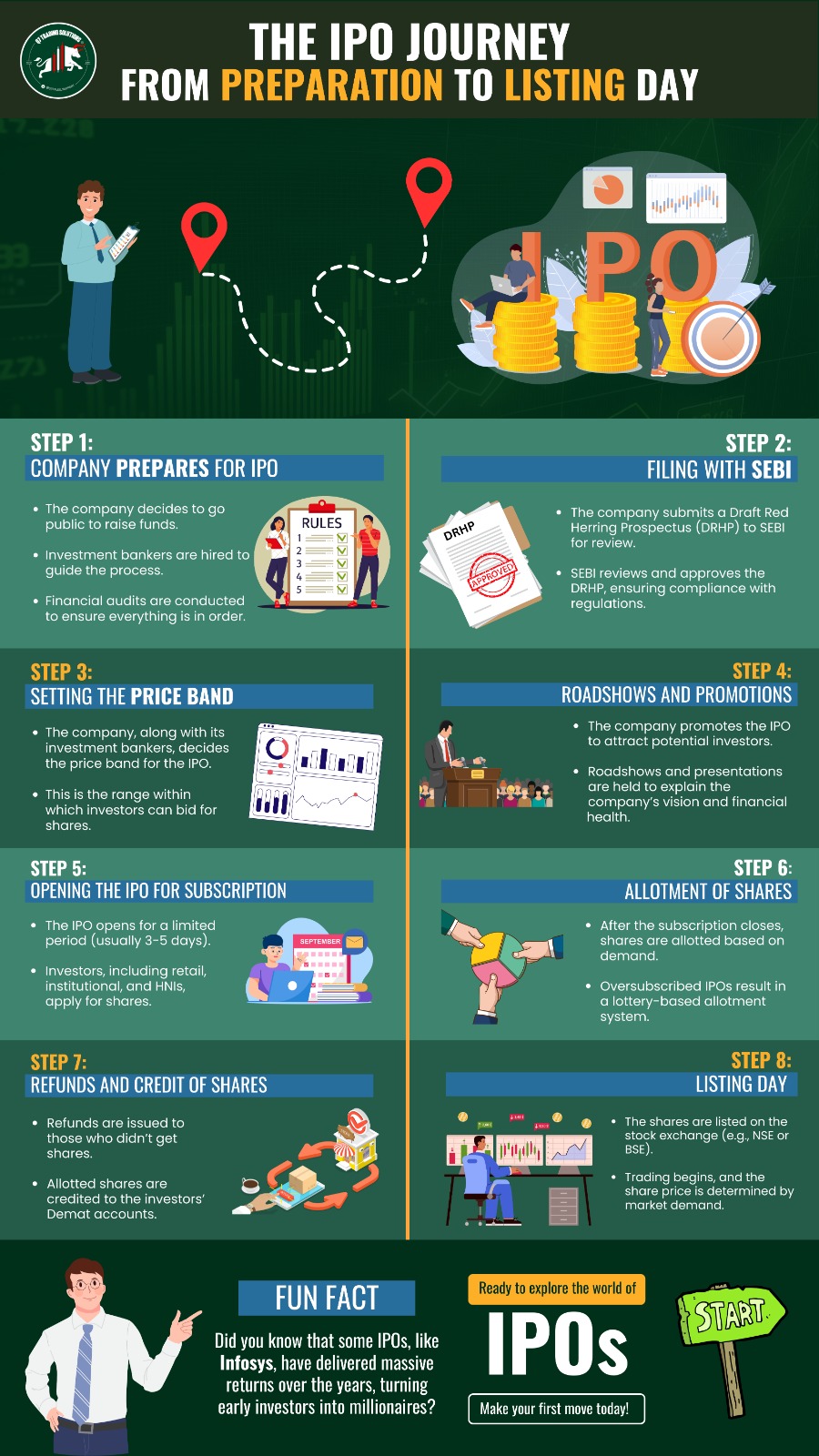

What Is an IPO?

First, let’s understand the Stock IPO meaning. An IPO (Initial Public Offering) is when a company decides to sell its shares to the public for the first time. Think of it as the company’s grand debut on the stock market stage. Before an IPO, only a few people, like founders or private investors, own shares. But once the IPO happens, the public—people like you and me—can buy a piece of the company.

Why Do Companies Go for IPOs?

Companies raise money through IPOs to expand their business, pay off debts, or fund new projects. For example, a growing tech startup might use IPO funds to develop new products or enter new markets.

What Are Stocks?

Stocks are shares of a company that are already listed on the stock exchange. Once a company goes public through an IPO, its shares can be bought and sold in the stock market. Whether you’re buying shares of Tata Motors or Reliance, you’re investing in a stock that’s already listed and being traded.

IPO vs Stock: Key Differences

Let’s get into the comparison between IPO vs Stock to make things clearer.

Why IPOs Are Exciting

- Chance to Buy Early: IPOs allow you to buy a company’s shares at the ground floor before they’re available in the open market. If the company grows, the early buyers often enjoy high returns.

- Big Debuts, Big Profits: Some IPOs make headlines by listing at a much higher price than the issue price. For example, Zomato’s IPO gave early investors a significant return.

Why IPOs Aren’t for Everyone

Here’s the thing about IPOs: Not everyone who applies gets shares. IPO allotments are a bit like a lottery—there’s no guarantee you’ll get the shares you want.

Let’s say an IPO gets oversubscribed (more people want to buy shares than what’s available). In that case, allotments are done on a random basis, and many applicants walk away empty-handed.

On the other hand, buying a stock that’s already listed on the market doesn’t have this problem. Anyone can buy shares of a listed company, as long as the market is open.

Why Stocks Are a Safer Bet

- Access Anytime: Stocks are always available, unlike IPOs, which have a limited window of opportunity.

- Historical Data: Stocks give you access to years of financial performance, helping you make informed decisions.

- Control Over Timing: Unlike IPOs, where you must buy during a specific period, stocks can be purchased at any time, depending on your strategy.

Which One Should You Choose?

The answer depends on your goals:

- Choose an IPO if you’re looking for early investment opportunities in promising companies. But remember, IPOs are a gamble, and allotments aren’t guaranteed.

- Choose stocks if you want to invest with more control, less uncertainty, and access to detailed historical performance data.

If you’re new to investing, starting with listed stocks might be the smarter choice. Once you understand market dynamics, you can explore IPOs for higher-risk, higher-reward opportunities.

Final Thoughts

Both IPOs and stocks offer unique opportunities, but they come with their own sets of risks and rewards. By understanding the differences, you can make smarter decisions and choose the investment that aligns with your goals.

If you’re feeling stuck or want to learn more, don’t hesitate to consult with a financial advisor. Remember, the stock market is a journey, and each step is a learning experience.

Happy investing!

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Investors are encouraged to perform their own analysis and seek professional guidance before making investment decisions.

Q7 Trading Solutions pioneers in algorithmic trading with tailored strategies for Stock options and Index options. Harnessing the power of AI and Big Data, we deliver precision in technical analysis using statistics & mathematical modeling, providing a reliable path to optimize trading outcomes. You can learn more about its prowess by joining our 28k+ strong community absolutely for FREE.