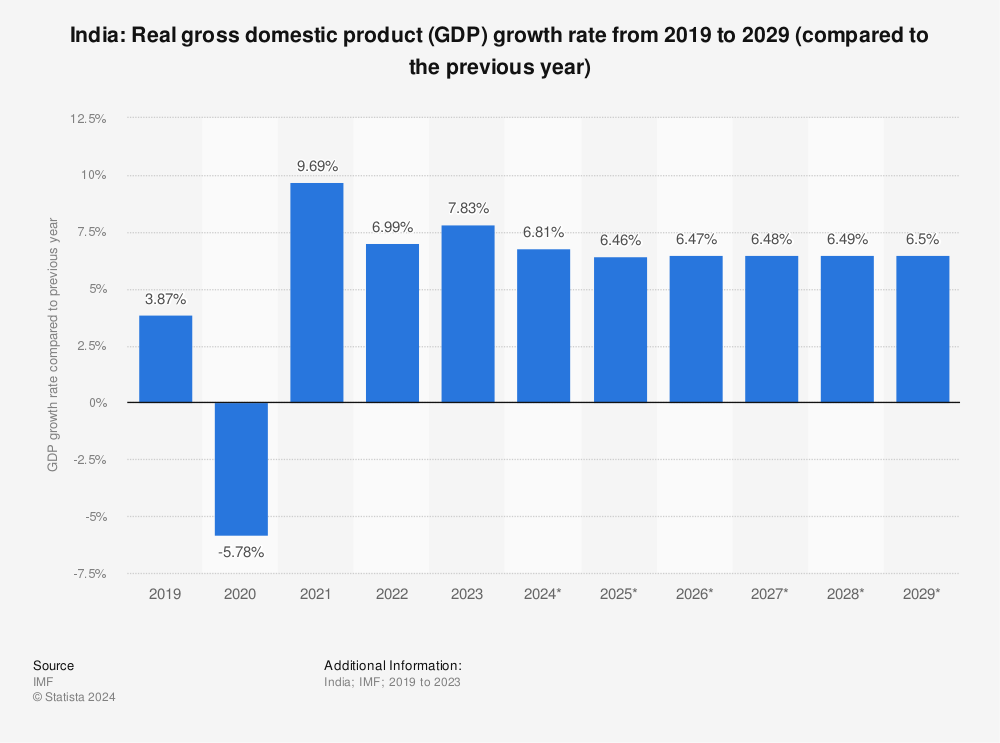

According to Reserve Bank of India Governor Shaktikanta Das, India’s GDP growth for 2022–2023 could exceed 7%. He added that there’s a chance GDP growth for the most recent fiscal year may have been more incredible. According to Das, financial markets continue to be erratic because of uncertainty regarding the future course of monetary policy.

According to rating agency Moody’s Investors Service, although India’s GDP exceeded USD 3.5 trillion in 2022, and it would be the G-20 economy with the fastest growth over the next few years, reform and policy obstacles may prevent investment. The US-based organization claimed in a research report that bureaucracy might hinder licensing and business registration clearance procedures, lengthening the project gestation period.

Growing nuclear families, a significantly educated workforce, and urbanization will fuel the need for homes, cement, and new cars. Government infrastructure spending will support cement and steel, while India’s aim for net-zero energy consumption will encourage investment in renewable energy. Despite the economy’s promising future, there is a chance that slower policy execution or limited economic liberalization would slow the investment rate in India’s manufacturing and infrastructure sectors.

The United Nations’ most recent World Economic Situation and Prospects report predicts that India’s GDP will grow by 5.8% in the calendar year 2023, driven by strong domestic demand. However, the research also highlighted how difficult investments and exports will continue due to the high cost of finance and sluggish external demand.

According to Moody’s, if the measures are carried out successfully—including those put in place during the pandemic to make labor laws more flexible, increase agricultural sector productivity, increase infrastructure investment, encourage manufacturing sector investment, and fortify the financial sector—this will result in higher economic growth.

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Investors are encouraged to perform their own analysis and seek professional guidance before making investment decisions.

Q7 Trading Solutions pioneers in algorithmic trading with tailored strategies for Stock options and Index options. Harnessing the power of AI and Big Data, we deliver precision in technical analysis using statistics & mathematical modeling, providing a reliable path to optimize trading outcomes. You can learn more about its prowess by joining our 28k+ strong community absolutely for FREE.