India’s Mutual Fund Boom in September 2025 witnessed total AUM reaching ₹75.61 lakh crore (+12.7% YoY), with monthly SIP inflows hitting an all-time high of ₹29,361 crore. Equity funds grew to ₹55 lakh crore while passive funds surged 12.9% to ₹12.65 lakh crore. With 25.2 crore investor accounts (up from 15.7 crore in 2023) and rising participation from Tier 2/3 cities, India’s retail investor revolution is transforming household savings from fixed deposits to market-linked wealth creation.

Table of Contents

- Chapter 1: The Record-Breaking September: India’s Mutual Fund Industry Hits New Milestones

- Chapter 2: The Big Numbers That Matter

- Chapter 3: Category-Wise Breakdown: Where Is the Money Going?

- Chapter 4: The Retail Investor 2.0: From Savers to Wealth Creators

- Chapter 5: Beyond the Metros: Tier 2 and Tier 3 Cities Lead the Charge

- Chapter 6: The B30 Revolution

- Chapter 7: Rising Investment Hubs

- Chapter 8: Who Are These New Investors?

- Chapter 9: What’s Driving This Surge?

- Chapter 10: What This Means for India’s Financial Future

- Chapter 11: Risks and Realities: Staying Grounded Amid Growth

- Chapter 12: The Bottom Line: India’s Retail Investor 2.0 Has Arrived

- Chapter 13: The Next Decade Belongs to Those Who Stay Invested

- Chapter 14: FAQs

Imagine this: It’s September 2025, and across India—from bustling Mumbai to quiet towns like Bhopal and Surat—millions of people are doing something their parents never did. They’re not just saving money in fixed deposits. They’re investing it. Systematically. Disciplinedly. And they’re doing it through something called a Systematic Investment Plan, or SIP.

This isn’t just a trend. It’s a revolution. And the numbers tell an extraordinary story.

The Record-Breaking September: India’s Mutual Fund Industry Hits New Milestones

September 2025 will be remembered as a watershed moment in Indian financial history. The mutual fund industry scripted yet another record-breaking chapter, one that validates a fundamental shift in how Indians think about money, wealth, and their financial future.

The Big Numbers That Matter

Total Assets Under Management (AUM): ₹75.61 Lakh Crore

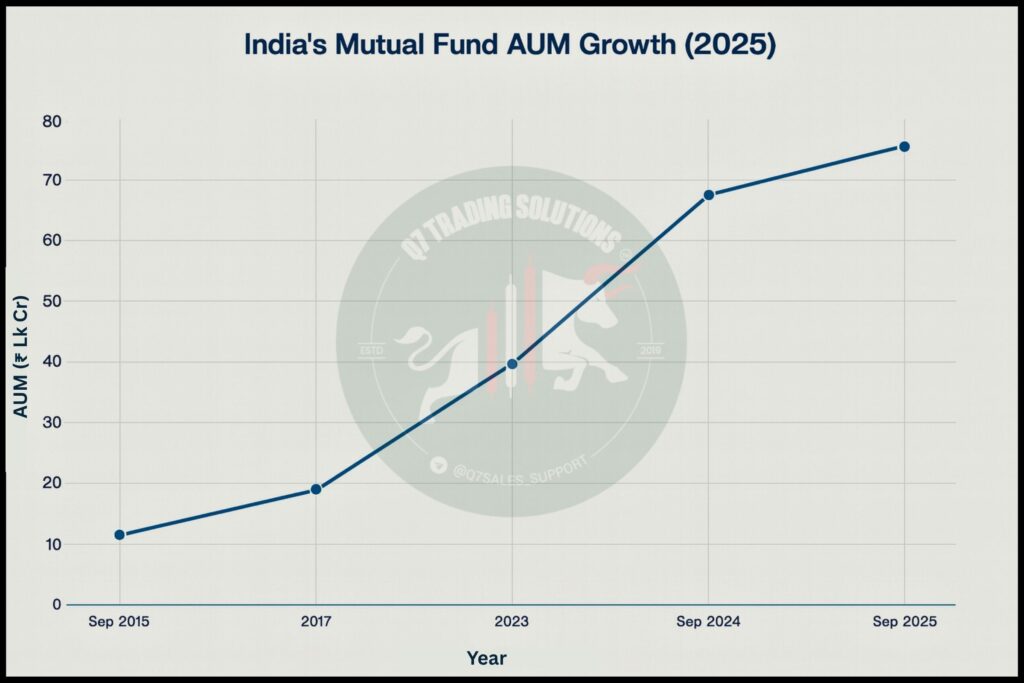

India’s mutual fund industry reached an all-time high, with total AUM touching ₹75.61 lakh crore in September 2025—a stellar 12.7% year-on-year growth from ₹67.09 lakh crore in September 2024. To put this in perspective, the industry has grown more than six-fold in just 10 years, from ₹11.87 trillion in September 2015.

India Mutual Fund Industry AUM Growth (2015-2025)

The pace of growth has accelerated dramatically post-pandemic. It took eight years for AUM to climb from ₹19.3 lakh crore in 2017 to ₹39.3 lakh crore in 2023. But in just the past two years, the industry’s asset base has nearly doubled to ₹71 lakh crore, highlighting the explosive momentum of retail participation.

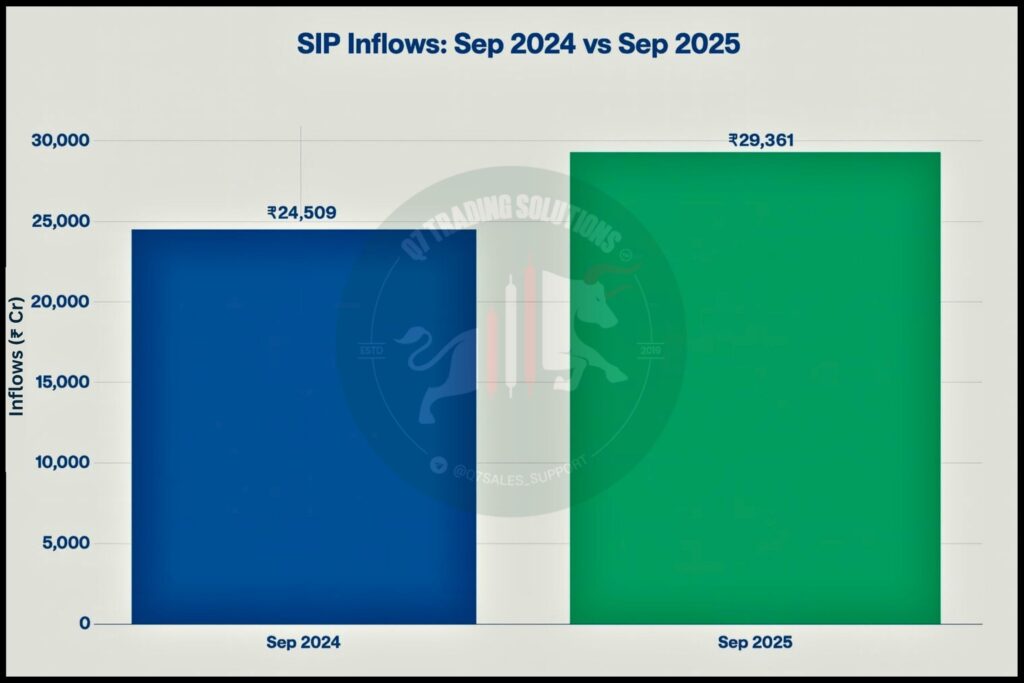

Monthly SIP Inflows: ₹29,361 Crore (All-Time High)

Systematic Investment Plan contributions hit a record ₹29,361 crore in September 2025, marking a 20% surge from ₹24,509 crore in September 2024. This represents the 55th consecutive month of positive equity fund inflows—a streak that showcases the unwavering commitment of Indian retail investors even amid market volatility.

The number of active SIP accounts climbed to 9.25 crore (92.5 million) in September from 8.98 crore in August, while SIP AUM reached ₹15.52 lakh crore, accounting for 20.2% of the industry’s total assets.

Year-on-Year SIP Inflow Growth (Sep 2024 vs Sep 2025)

Systematic Investment Plan contributions hit a record ₹29,361 crore in September 2025, marking a 20% surge from ₹24,509 crore in September 2024. This represents the 55th consecutive month of positive equity fund inflows—a streak that showcases the unwavering commitment of Indian retail investors even amid market volatility.

Year-on-Year SIP Inflow Growth (Sep 2024 vs Sep 2025)

The number of active SIP accounts climbed to 9.25 crore (92.5 million) in September from 8.98 crore in August, while SIP AUM reached ₹15.52 lakh crore, accounting for 20.2% of the industry’s total assets.

Venkat N Chalasani, Chief Executive of AMFI, captured the moment perfectly:

“SIPs reached a new milestone with record monthly contributions of ₹29,361 crore and 9.25 crore active accounts, reaffirming retail investors’ growing preference for disciplined and systematic investing.”

Category-Wise Breakdown: Where Is the Money Going?

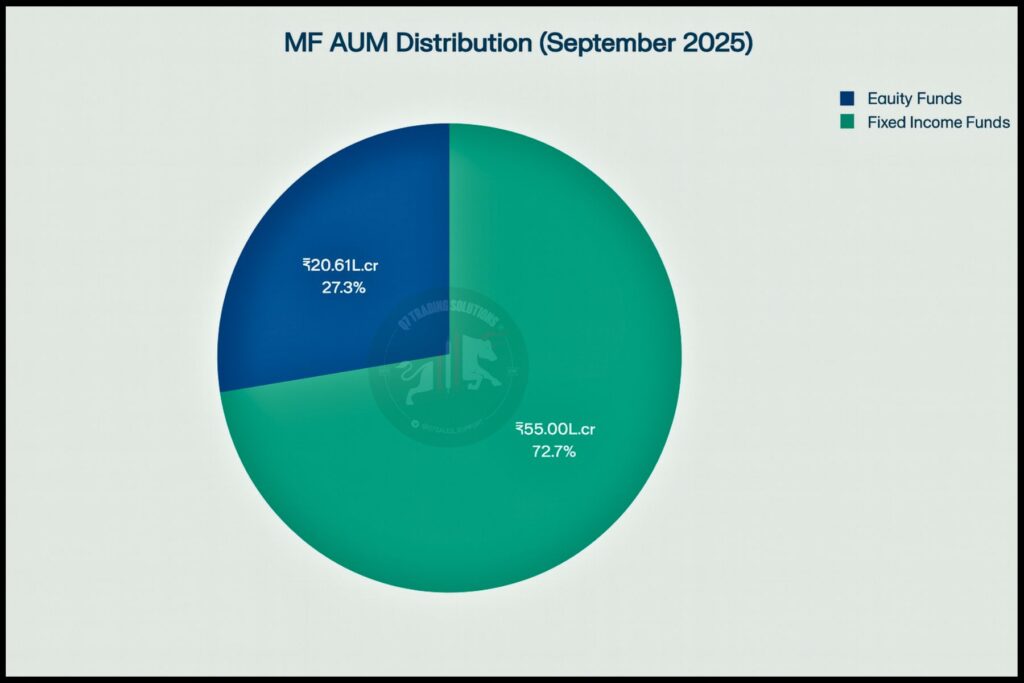

1. Equity-Oriented Funds: The Long-Term Wealth Engine

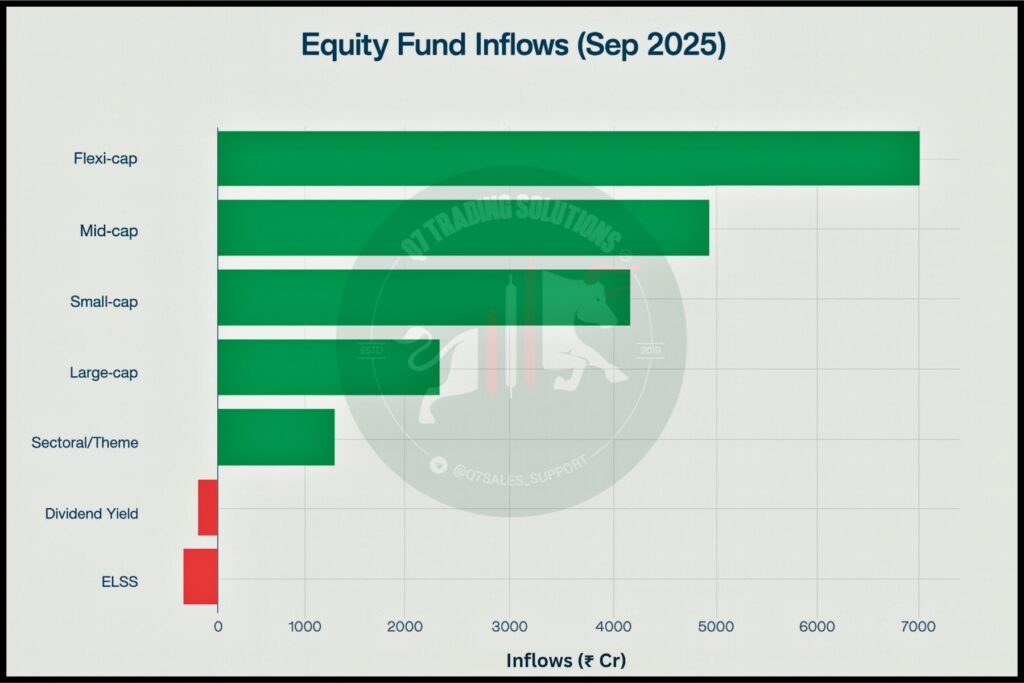

Equity funds continue to dominate the landscape, accounting for approximately ₹55 lakh crore or 72.7% of total AUM, reflecting a robust 9.5% year-on-year growth. Within the equity category, investor preferences in September revealed clear trends:

- Flexi-cap funds attracted the highest inflows at ₹7,029 crore

- Mid-cap funds followed with ₹5,085 crore

- Small-cap funds drew ₹4,362 crore

- Large-cap funds received ₹2,319 crore, reflecting investor caution amid elevated valuations

- Sectoral & thematic funds gathered ₹1,220 crore

Notably, Equity Linked Savings Schemes (ELSS) saw net outflows of ₹308 crore, while dividend yield funds experienced outflows of ₹168 crore.

Overall equity fund inflows stood at ₹30,422 crore in September, down slightly from ₹33,417 crore in August—the second consecutive month of moderation after July’s peak of ₹42,703 crore. However, this shouldn’t be misread as weakening sentiment. Industry experts attribute the dip partly to a busy IPO calendar in September that diverted retail capital temporarily.

2. Fixed Income Funds: The Smart Money Hedges Volatility

Fixed income-oriented funds surged an impressive 22.2% year-on-year to ₹20.61 lakh crore. However, September saw net outflows of ₹1.02 lakh crore, largely due to quarter-end portfolio rebalancing and advance tax payments.

Within debt categories:

- Liquid funds recorded maximum outflows of ₹66,042 crore

- Money market funds, ultra-short duration, and short duration funds also saw significant outflows

- Only overnight funds (₹4,279 crore), medium-to-long duration, long duration, and dynamic bond funds attracted positive inflows

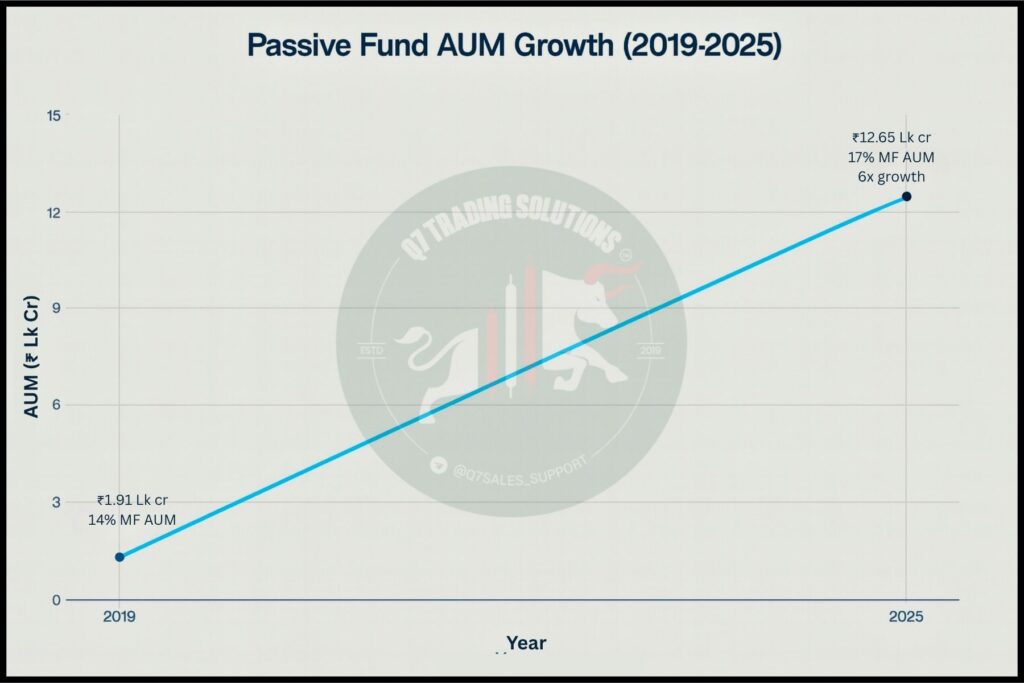

3. Passive Funds: The ETF Wave Goes Mainstream

Passive funds—comprising index funds and ETFs—now command ₹12.65 lakh crore in AUM, representing 17% of the total market and marking a 12.9% year-on-year growth. This is a dramatic rise from just 1.4% of total mutual fund assets in 2015.

September witnessed particularly strong passive fund inflows of ₹19,056 crore, with nearly ₹14,000 crore flowing into gold and silver ETFs alone—highlighting renewed interest in precious metals amid global uncertainty.

ETF folios have exploded from 18 lakh in March 2020 to nearly 2 crore in March 2025, while index fund folios climbed from 5 lakh to over 1.25 crore in the same period. According to a Motilal Oswal survey, 68% of retail investors now hold at least one passive fund, up from 61% in 2023.

Vishal Jain, CEO of Zerodha Fund House, emphasized:

“This isn’t just a short-term trend but a fundamental change in how Indians think about growing their money.”

4. Hybrid Funds: Balancing Growth and Safety

Hybrid schemes, offering a blend of equity and debt exposure, recorded net inflows of ₹9,397 crore in September, largely driven by multi-asset allocation funds that attracted ₹4,982 crore. These funds appeal to investors seeking diversification and moderate risk-adjusted returns.

The Retail Investor 2.0: From Savers to Wealth Creators

The Numbers Behind the Revolution

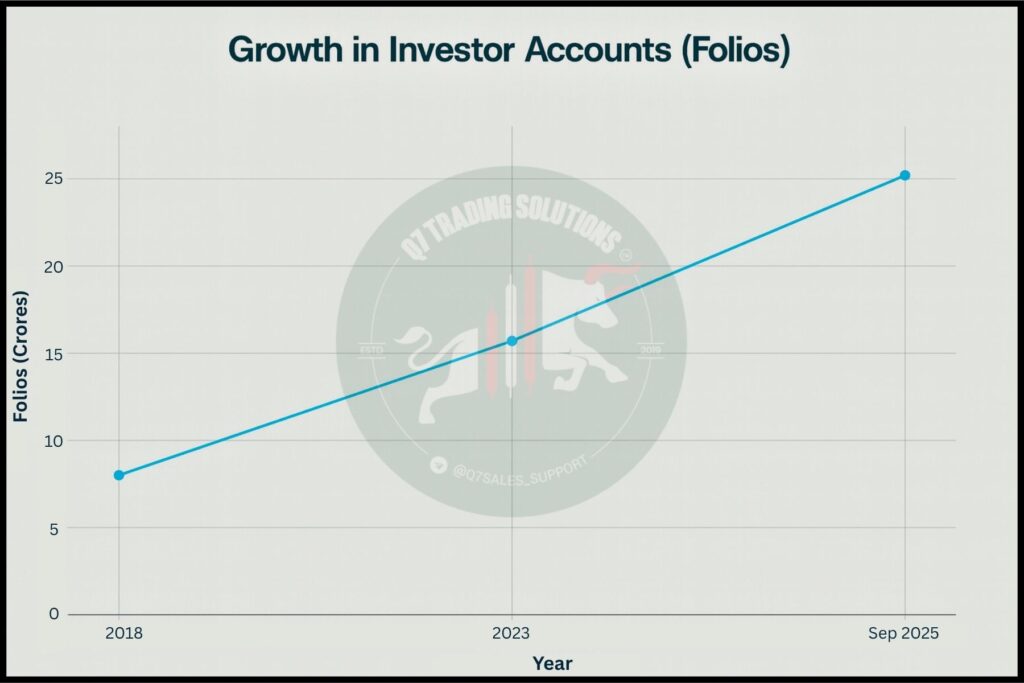

The transformation of Indian households from savers to investors is not anecdotal—it’s backed by hard data:

- Total investor accounts (folios): 25.2 crore in September 2025, up from 15.7 crore in 2023—a doubling in just two years

- Retail folios in equity, hybrid, and solution-oriented schemes: 19.8 crore

- Addition of new folios in September alone: Over 30 lakh

- Direct plan adoption: 48% of total AUM, showcasing growing investor confidence to invest without intermediaries

By comparison, between 2018 and 2023, it took six years for folios to double from 8 crore, underscoring the accelerated pace of retail inclusion post-pandemic.

Shifting from FDs to Mutual Funds

Traditional bank fixed deposits are losing their grip on household savings. Data from the Reserve Bank of India shows:

- Household term deposits declined to 45.77% at the end of FY 2025, down from 50.54% in 2020

- Mutual fund share in household gross financial savings jumped from 0.9% in 2011-12 to 6% in 2022-23

- Mutual fund AUM as a percentage of bank deposits rose from 13% in FY15 to 31% in May 2025

Uday Kotak, Founder of Kotak Mahindra Bank, captured this shift perfectly:

“India’s savers are turning investors.”

He called it a “huge post-COVID shift” but also cautioned against “excessive exuberance”.

The proportion of households investing in risky assets climbed to 17.8% in 2022 from 15.7% in 2019, according to an RBI study. Meanwhile, the share of equities, debentures, and mutual funds in household portfolios rose from 0.5% to 0.9% between FY21 and FY24.

For more insights on why patient, disciplined investing in equity mutual funds pays off over time, read our detailed analysis: Why Equity Mutual Funds & PMS Are Shining — and Why Patience Pays

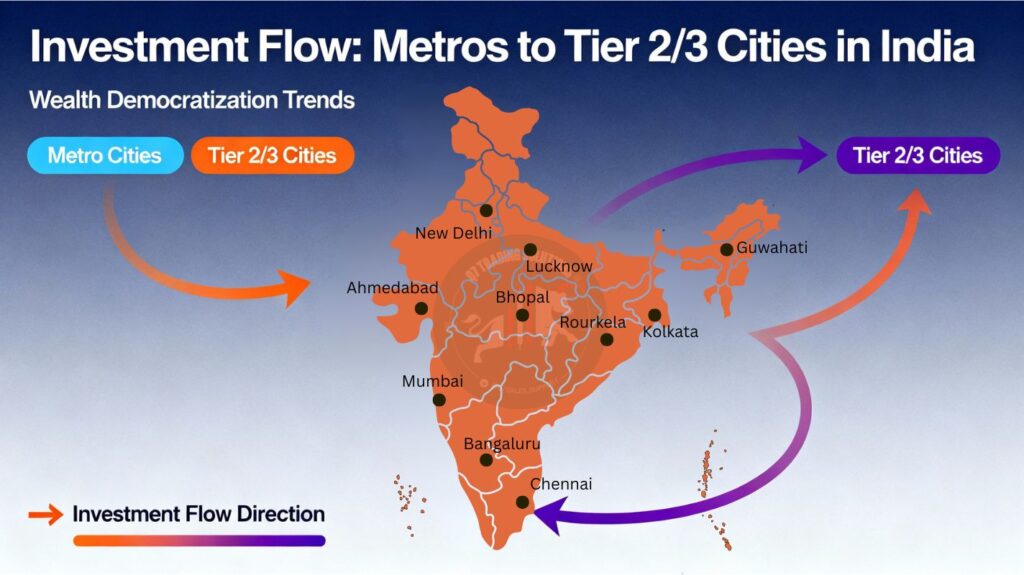

Beyond the Metros: Tier 2 and Tier 3 Cities Lead the Charge

One of the most transformative aspects of India’s mutual fund boom is its geographic democratization. Investment is no longer a metro-centric phenomenon.

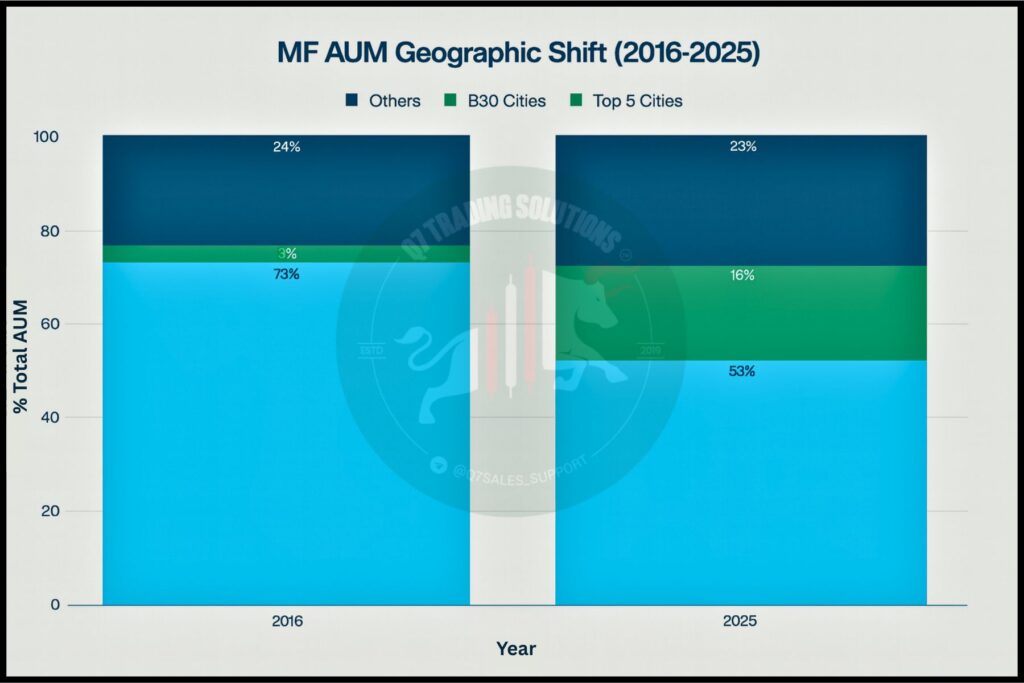

The B30 Revolution

B30 locations (Beyond Top 30 cities) now account for 18% of the mutual fund industry’s total AUM as of July 2025. AUM from these regions rose from ₹13.80 lakh crore in June 2025 to ₹14.20 lakh crore in July 2025—a 3% monthly increase and a robust 21% year-on-year growth.

The combined share of India’s top five cities—Mumbai, Delhi, Bengaluru, Kolkata, and Pune—has fallen from 73% in 2016 to 53% in 2025, while other cities’ contribution has climbed from just 3% to nearly 19%.

Rising Investment Hubs

Emerging cities are rapidly gaining prominence:

- Surat: Share increased to 0.77% from 0.55% in 2016

- Lucknow: Rose to 0.68% from 0.50%

- Jaipur: Climbed to 0.85% from 0.72%

- Bhopal: 0.35% from 0.21%

- Vadodara: 0.86% from 0.71%

- Nagpur: 0.56% from 0.43%

- Hyderabad, Ahmedabad: Steady gains across the board

Who Are These New Investors?

The demographic profile of the new investor class reveals fascinating trends:

- Age: Investors aged 25-40 dominate new folio registrations

- Income: Middle-income groups lead SIP adoption, typically investing ₹500-₹2,000 monthly

- Gender: More women from smaller towns are entering the investment space, supported by digital platforms and outreach programs

- Geography: States like Chandigarh, Himachal Pradesh, and Dadra & Nagar Haveli report SIP AUM shares exceeding 40% of total MF AUM

What’s Driving This Surge?

Several structural factors are accelerating mutual fund adoption beyond metros:

- Digital Penetration: Affordable smartphones and data plans have made investing accessible to millions. Government digitization initiatives have been major enablers.

- Fintech Expansion: Platforms like Groww, Zerodha, Paytm Money, and Angel One have simplified investing for first-time users in Tier 2 and Tier 3 cities.

- Financial Literacy Campaigns: YouTube channels, finance apps, free webinars, and AMFI’s investor awareness programs are educating people about stocks, mutual funds, and systematic investing.

- Improved Distributor Reach: Mutual fund distributors and registered investment advisers are expanding their footprint into smaller towns, bringing professional guidance closer to retail investors.

What’s Driving This Surge?

Several structural factors are accelerating mutual fund adoption beyond metros:

- Digital Penetration: Affordable smartphones and data plans have made investing accessible to millions. Government digitization initiatives have been major enablers.

- Fintech Expansion: Platforms like Groww, Zerodha, Paytm Money, and Angel One have simplified investing for first-time users in Tier 2 and Tier 3 cities.

- Financial Literacy Campaigns: YouTube channels, finance apps, free webinars, and AMFI’s investor awareness programs are educating people about stocks, mutual funds, and systematic investing.

- Improved Distributor Reach: Mutual fund distributors and registered investment advisers are expanding their footprint into smaller towns, bringing professional guidance closer to retail investors.

What This Means for India’s Financial Future

1. The Liquidity Base of Equity Markets Is Expanding

With SIP-led inflows providing a steady stream of capital, India’s equity markets now have a domestic cushion against foreign institutional investor (FII) volatility. Even when FIIs turn net sellers—as they did through much of 2024-25—domestic inflows have prevented sharp market corrections.

As Pankaj Shrestha, Head of Investment Advisory at PL Capital, notes:

“Equity mutual fund schemes have now recorded net inflows for 55 straight months. This consistency is not just a response to market highs. It signals a structural change in how Indian families save and invest.”

2. Smart Capital Rotation Between Equity and Fixed Income

The simultaneous growth in both equity and debt funds indicates strategic maturity among retail investors. They’re not blindly chasing equity returns—they’re building balanced portfolios with growth and safety components.

3. Passive Investing Is No Longer Niche

The six-fold growth in passive fund AUM since 2019 reflects a fundamental shift. Investors are increasingly recognizing the benefits of low-cost, diversified, index-tracking strategies for long-term wealth creation. Key drivers include:

- Low costs (54% cite this as a primary reason)

- Diversification (46%)

- Simplicity and transparency (46%)

- Performance (29%)

Distributors are responding: 93% plan to increase passive allocation by at least 5% in FY26.

4. Household Shareholding Power Is Rising

Mutual funds’ shareholding in companies listed on the National Stock Exchange (NSE) has risen from 3.7% in March 2010 to 10.4% in March 2025. This growing clout positions mutual funds as stabilizing institutional investors, cushioning markets during FII-driven volatility.

5. The Demographic Dividend Is Being Channeled Productively

India’s young population is no longer content with 6% FD returns. They’re seeking market-linked growth, retirement planning, and financial independence—and mutual funds are their vehicle of choice.

Risks and Realities: Staying Grounded Amid Growth

While the numbers are exhilarating, caution is warranted. SEBI Chairman Tuhin Kanta Pandey noted that despite crossing ₹75 lakh crore in AUM, household participation in mutual funds remains at just 6.7%, though 53% of households are aware of mutual funds.

“Total AUM of the industry is still under 25% of national GDP, well below the 80% average of advanced economies,” Pandey stated, calling mutual funds “one of the biggest untapped growth levers” while emphasizing the need to expand inclusion responsibly.

Additionally:

- Urban participation in securities markets stands at 15%, compared to just 6% in rural areas.

- Sustained market weakness over the next 12-18 months could lead to temporary moderation in flows, particularly among new investors yet to experience full market cycles.

- Pankaj Shrestha cautions: “Could the momentum slow down? Yes, if we see prolonged flat or negative market phases. However, given resilient domestic demand and corporate earnings momentum, such a scenario doesn’t currently appear likely.”

The Bottom Line: India’s Retail Investor 2.0 Has Arrived

The September 2025 mutual fund data isn’t just a collection of record-breaking numbers. It’s evidence of a profound behavioral shift—a financial democratization happening across India’s cities, towns, and even villages.

India’s middle class is transforming from “savers” to “investors,” one SIP at a time. This is not speculative, FOMO-driven investing. It’s disciplined, long-term, goal-oriented wealth creation. The compounding revolution has truly gone mass-market.

The Next Decade Belongs to Those Who Stay Invested

The moral of this story is clear: Those who stay invested, who embrace discipline over panic-selling, who trust the power of compounding, will build lasting wealth.

As the data shows, SIP investors didn’t stop when the Nifty went flat. They didn’t exit when FIIs sold. They stayed the course—and that’s what makes this revolution sustainable.

At Q7 Trading Solutions, we believe in empowering investors with research-driven insights, data-backed strategies, and a long-term perspective on wealth creation. Whether you’re exploring equity mutual funds, SIP strategies, or algorithmic trading, we provide the intelligence you need to navigate India’s dynamic financial landscape.

Ready to join India’s retail investment revolution? Let discipline, not emotion, guide your journey.

FAQs

India’s mutual fund industry reached ₹75.61 lakh crore in AUM as of September 2025, marking a 12.7% year-on-year growth.

SIP (Systematic Investment Plan) inflows represent monthly contributions by retail investors. They hit an all-time high of ₹29,361 crore in September 2025, driven by disciplined investing habits and growing retail participation.

Yes, significantly. B30 locations (Beyond Top 30 cities) now account for 18% of total AUM, with cities like Surat, Jaipur, and Bhopal showing robust growth. The combined share of top 5 metros has fallen from 73% in 2016 to 53% in 2025.

Key drivers include rising inflation eroding FD real returns, growing financial literacy, digital access via fintech platforms, and the desire for higher market-linked returns. Mutual fund AUM as a percentage of bank deposits rose from 13% in FY15 to 31% in FY25.

Yes, passive fund AUM has surged six-fold from ₹1.91 lakh crore in 2019 to ₹12.2 lakh crore in 2025. Now 68% of retail investors hold at least one passive fund, driven by low costs, diversification, and simplicity.