The India–Chile critical minerals FTA is a soon‑to‑be‑concluded free trade agreement that aims to give India long‑term, preferential access to Chile’s rich reserves of lithium, copper, cobalt, molybdenum and rhenium — minerals that are essential for EV batteries, electronics manufacturing and clean energy infrastructure. By upgrading the existing India–Chile trade pact into a deeper agreement focused on critical minerals, India hopes to reduce supply‑chain risks, support its domestic manufacturing goals and strengthen strategic autonomy in the age of green technologies.

Table of Contents

- Chapter 1: What exactly is the India–Chile critical minerals FTA?

- Chapter 2: Why Chile matters so much for India’s lithium and critical minerals strategy

- Chapter 3: How this FTA could transform India’s EV, electronics and clean energy sectors

- Chapter 4: Early moves: how India is already positioning in Chile

- Chapter 5: The “FTA no one is talking about” — why it’s under the radar

- Chapter 6: How this FTA fits into India’s broader critical minerals playbook

- Chapter 7: FAQs

If you care about India’s EV story, electronics manufacturing, or solar push, there’s one trade deal you should be watching very closely: the emerging India–Chile critical minerals FTA. The negotiations are in advanced stages, and this pact could quietly become one of the most important building blocks of India’s green growth and manufacturing strategy.

While headlines are dominated by larger‑than‑life talks with the US or EU, Chile — a country many Indians rarely think about — holds exactly what India needs: some of the world’s richest reserves of lithium, copper, cobalt, rhenium and molybdenum, the backbone minerals for EV batteries, electronics, and clean energy infrastructure.

What exactly is the India–Chile critical minerals FTA?

India and Chile already have a Preferential Trade Agreement (PTA) that was expanded in 2017, but both sides are now moving towards a deeper free trade agreement/CEPA which explicitly prioritises access to critical minerals.

Commerce and Industry Minister Piyush Goyal has publicly said that negotiations will “be closed soon” and that the pact “will open up critical minerals” for Indian businesses, indicating the talks are in their final stretch rather than just exploratory discussions.

Key contours (as publicly indicated)

- Upgrade from a limited PTA to a broader FTA/CEPA covering goods, services and investment.

- Strategic focus on critical minerals: lithium, copper, rhenium, molybdenum, cobalt.

- Objective to support India’s electronics, auto/EV and solar sectors with more reliable mineral access.

Why Chile matters so much for India’s lithium and critical minerals strategy

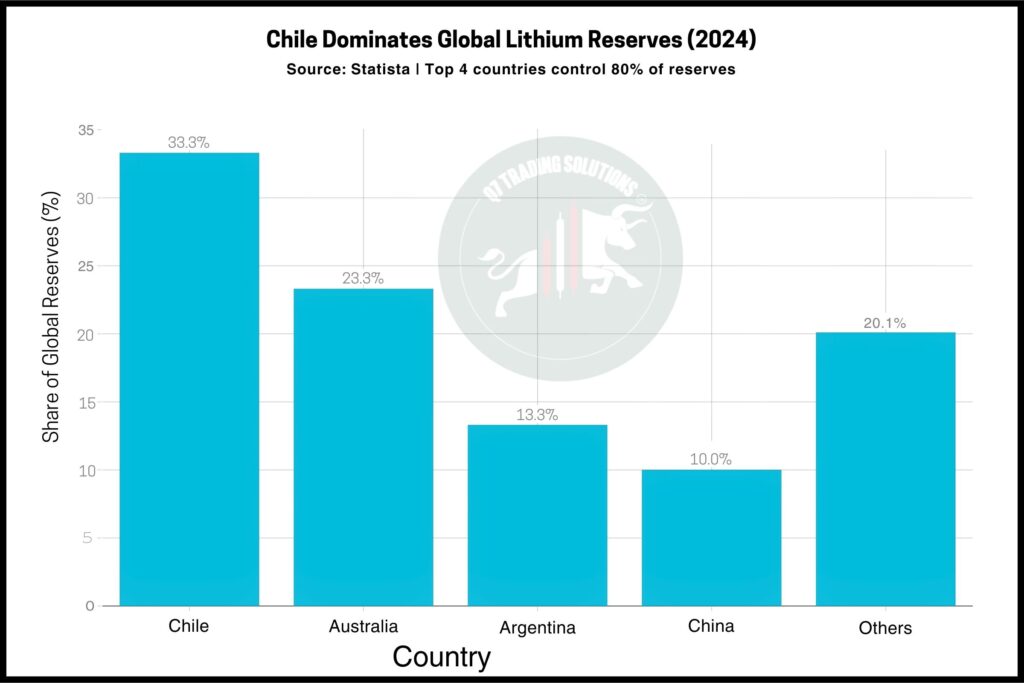

Chile is not just “another” resource‑rich country. It sits on some of the largest lithium reserves on the planet and is also a heavyweight in copper and other critical metals.

Chile’s critical minerals profile (illustrative table)

| Mineral | Why it matters for India | Chile’s role (global context) |

|---|---|---|

| Lithium | EV batteries, grid‑scale storage, consumer devices | Among the top countries by reserves and production. |

| Copper | Power grids, EV motors, electronics, renewables | One of the world’s largest copper producers. |

| Cobalt | Battery cathodes, high‑performance alloys | Part of Chile’s broader critical mineral basket. |

| Molybdenum | Steel strengthening, energy, industrial equipment | Significant reserves tied to copper mining. |

| Rhenium | High‑temperature turbine alloys, aerospace | Present in copper deposits and considered a strategic metal. |

Industry commentary stresses that these minerals are now “strategic assets” rather than just industrial inputs, and that access to them is increasingly used as a geopolitical lever.

How this FTA could transform India’s EV, electronics and clean energy sectors

Let’s break it down from an Indian market and investor lens.

1. EVs and advanced batteries

India’s EV targets (for two‑wheelers, three‑wheelers, and passenger vehicles) hinge on dependable access to battery materials like lithium and cobalt.

-

Reduced import risk: Long‑term offtake plus friendlier tariff and investment terms with Chile can partially de‑risk India’s current dependence on a narrow set of suppliers and processors, many of which are dominated by China.

-

Support for local cell manufacturing: India is pushing domestic cell and battery pack manufacturing under PLI schemes and other incentives; secure feedstock from Chile will make localisation economically more viable.

-

Better pricing and planning visibility: Structured agreements can improve price visibility and supply planning for Indian EV OEMs and battery manufacturers over multi‑year horizons.

2. Electronics and semiconductor‑adjacent manufacturing

Copper and other critical metals are essential for everything from consumer electronics to data centres.

-

Make in India electronics: More reliable copper and related inputs help support PCB manufacturing, wiring, motors, and power electronics for both domestic and export markets.

-

Critical inputs for fabs, power systems, and high‑end equipment: As India courts semiconductor and electronics investments, access to these metals becomes a competitive factor.

3. Clean energy and grid infrastructure

Solar panels, inverters, transmission lines, and energy storage all need large volumes of copper, and in many cases, specialty metals such as molybdenum and rhenium.

-

Scaling renewables: A smoother pipeline of these minerals can support India’s solar and wind deployment by lowering material risk.

-

Grid upgrades for EVs and data centres: As EV charging and digital infrastructure expand, copper‑heavy grid investments will become even more important.

Early moves: how India is already positioning in Chile

Even before the FTA is signed, Indian public‑sector and private players are quietly building a foothold.

-

Coal India’s Chile arm: Coal India Ltd’s board has approved setting up an intermediate holding company in Chile to pursue critical minerals opportunities, including lithium and copper, explicitly linked to the FTA context.

-

Corporate partnerships in copper: Chilean state miner Codelco and India’s Adani Group have signed an agreement to examine three copper projects in Chile, signalling early private‑sector positioning.

-

Broader government push: In parallel, India is also in discussions with Brazil, Canada, France and the Netherlands on critical minerals deals, with a focus on lithium, rare earths and mineral‑processing technologies, showing that Chile is part of a larger diversification strategy.

These moves demonstrate that policymakers and corporations are treating critical minerals as a long‑term strategic domain rather than chasing short‑term spot‑market bargains.

The “FTA no one is talking about” — why it’s under the radar

A widely cited analysis by The Economic Times calls this the “FTA no one is talking about” and argues it could give India a major strategic edge.

There are a few reasons it has stayed low‑profile:

-

Media bandwidth: High‑profile negotiations with the US and EU eat up most of the commentary space.

-

Commercial sensitivity: Terms relating to offtake, pricing bands and investment rights in mining can materially affect corporate strategies and international competition, so negotiators prefer quiet progress.

-

Geo‑economic signalling: In the context of critical minerals “weaponisation”, countries often avoid over‑telegraphing their sourcing strategies until agreements are final.

For savvy Indian investors, founders, and policymakers, this information asymmetry is actually an opportunity: the market has not fully priced in the significance of the Chile deal for India’s EV, energy and manufacturing ecosystem.

How this FTA fits into India’s broader critical minerals playbook

India’s push with Chile is not happening in isolation.

-

Reuters reporting notes that India is simultaneously negotiating critical minerals deals with Brazil, Canada, France and the Netherlands, focused on lithium, rare earths and processing technologies.

-

Policy analysts see this as part of a broader drive to reduce dependence on China, which currently dominates many critical mineral supply chains and processing technologies.

-

The Chile pact stands out because it combines both resource access and the potential for long‑term industrial collaboration in mining, processing and downstream manufacturing.

For India, this is not just about importing ore; it is about embedding itself deeper into the global value chains that will define the next decade of clean growth.

FAQ section

No, the agreement is not yet signed, but Commerce Minister Piyush Goyal has stated that negotiations “will be closed soon”, indicating they are in an advanced stage and nearing conclusion.

Chile holds some of the world’s largest reserves of lithium and is a major producer of copper and other critical minerals, all of which are central to EV batteries, electronics and renewable energy technologies that India wants to scale.

Indian companies in sectors such as EVs, batteries, electronics and solar equipment could gain more reliable and possibly more competitively priced access to critical minerals, which helps long‑term planning, reduces supply‑chain risk and supports local manufacturing.

Alongside the Chile FTA, India is also in talks with Brazil, Canada, France and the Netherlands on minerals and processing technology, as part of a wider strategy to diversify away from heavy dependence on China‑centric supply chains.

Coal India has approved a Chile‑based intermediate holding company for critical minerals such as lithium and copper, and Chilean state miner Codelco has teamed up with India’s Adani Group to explore copper projects, showing early corporate alignment with the upcoming FTA.