HDFC Bank’s 9.5–10% stake in IndusInd Bank is a strategic investment that boosts IndusInd’s credibility, signals confidence in governance, and may trigger a valuation re-rating. For HDFC, it’s a low-risk move offering optional exposure to private banking consolidation without significant balance sheet impact.

Table of Contents

- Chapter 1: Why This Is a Big Deal

- Chapter 2: Impact on IndusInd Bank: Confidence and Credibility Boost

- Chapter 3: Limitations — Let’s Stay Realistic

- Chapter 4: Impact on HDFC Bank: Smart Strategic Optionality

- Chapter 5: What It Won’t Do for HDFC

- Chapter 6: Market Psychology: Why Sentiment Matters More Than Numbers

- Chapter 7: Verdict: Who Benefits More?

- Chapter 8: Final Thoughts

- Chapter 9: FAQs

When India’s most trusted private lender, HDFC Bank, receives regulatory approval to buy up to 9.5–10% stake in IndusInd Bank, it’s not just another corporate investment. It’s a signal — one that could reshape confidence and sentiment in India’s private banking landscape.

This move isn’t a merger or takeover. Rather, it’s a strategic equity investment — a quiet but powerful statement from HDFC Bank about IndusInd’s trajectory and the broader future of private banking in India.

Why This Is a Big Deal

HDFC Bank’s involvement naturally commands attention. Often described as the “gold standard” in Indian banking for its robust risk management and consistent performance, any stake purchase by HDFC serves as a stamp of institutional approval.

According to the RBI’s norms, large private banks need explicit approval to invest in other financial institutions beyond certain thresholds. So, HDFC’s move comes not only as a greenlight from regulators but as a vote of confidence in IndusInd Bank’s stability and long-term outlook.

Impact on IndusInd Bank: Confidence and Credibility Boost

Let’s break this down.

1. Credibility & Confidence Re-rating

HDFC Bank’s entry sends a message to the markets — “We trust this bank.” That’s priceless in a sector where trust dictates valuation. IndusInd has faced scrutiny in past years over governance and executive churn; this development significantly repairs sentiment.

2. Valuation Uplift Possibility

Markets typically reward banks attracting top-tier investors. Expect the following changes:

- Improved market perception

- Reduced risk premium on the stock

- Gradual price-to-book multiple re-rating, if earnings stability follows

Historically, such strategic stake buys have improved peer valuations, as seen in similar instances across SBI subsidiaries and private banking tie-ups (Business Standard analysis).

3. Institutional Stability

Leadership transitions can unsettle markets, but a major shareholder like HDFC Bank provides a steadying presence. It acts as a soft anchor investor, encouraging better governance and shareholder alignment.

4. Scope for Strategic Collaboration

HDFC and IndusInd both serve similar retail and MSME segments. While no partnership is announced, such shareholdings often facilitate:

- Knowledge sharing in credit risk and technology innovation

- Mutual insights into digital banking trends and customer models

- Potential synergy in future product or lending ecosystems

Limitations — Let’s Stay Realistic

However, this is not a control transaction. HDFC Bank will not alter IndusInd’s management or board operations. Any short-term rally may simmer down unless backed by consistent performance improvement in coming quarters.

Investors need to view this as a sentiment catalyst, not a turnaround trigger.

Impact on HDFC Bank: Smart Strategic Optionality

From HDFC’s lens, this move ticks every institutional box — optional upside, limited downside.

-

Sectoral Optionality

By taking a 10% stake, HDFC Bank gains strategic visibility into another mid-sized bank’s operations. Should the private banking sector consolidate further — as experts at The Economic Times predict could happen — HDFC is well-positioned with early exposure. -

Financial Investment Benefits

If IndusInd Bank executes well over the next few years, HDFC could enjoy capital appreciation on its stake and recurring dividend income, without heavy risk exposure. -

Minimal Balance Sheet Impact

Given HDFC’s massive balance sheet and capital adequacy ratio (above 18% as per FY2025 reports), this acquisition doesn’t dent liquidity or growth budgets.

What It Won’t Do for HDFC

Let’s be clear — this transaction won’t move the needle immediately for HDFC’s earnings or valuation.

It’s less about quarterly EPS and more about long-game positioning.

No balance sheet strain, no operational integration, no managerial impact — just calculated strategic visibility.

Market Psychology: Why Sentiment Matters More Than Numbers

This news has a strong psychological impact on India’s banking investors.

-

For IndusInd Bank, it’s a confidence event — a validation stamp by India’s top lender.

-

For HDFC Bank, it’s a strategic chess move — observing, not integrating.

-

For investors, it shows the early signs of private banking consolidation in India — an area the RBI has hinted might gain traction over the next few years (Mint).

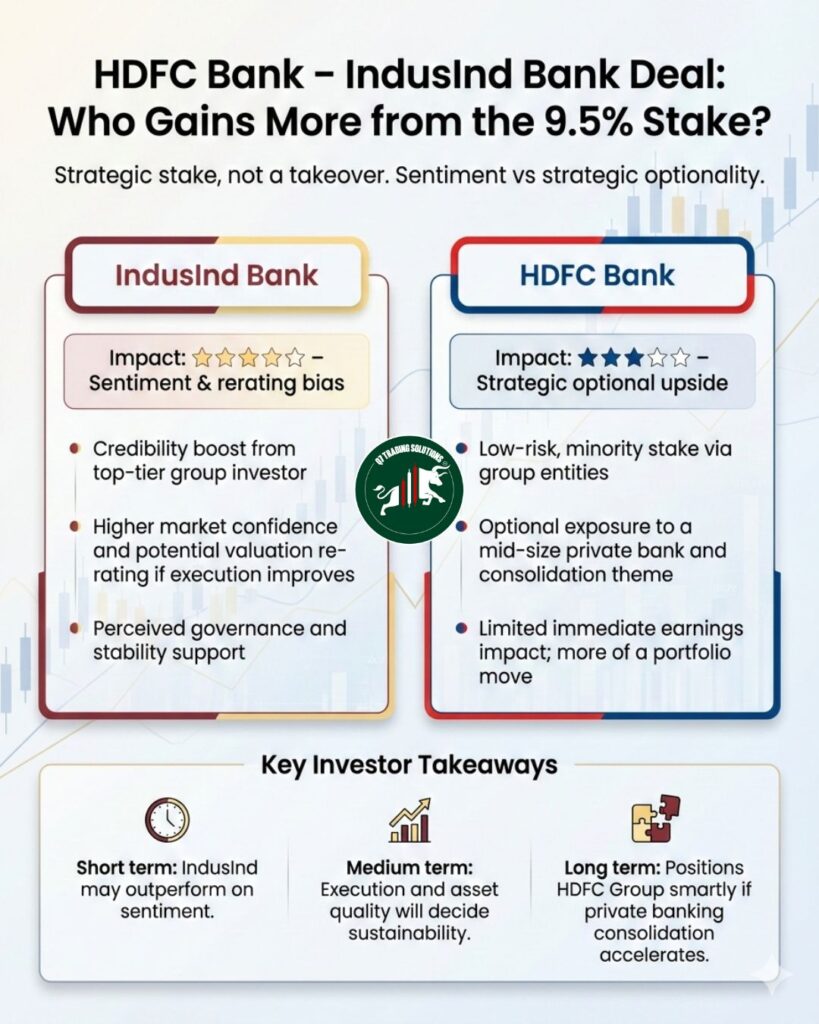

Verdict: Who Benefits More?

| Bank | Market Impact | Key Takeaway |

|---|---|---|

| IndusInd Bank | ⭐⭐⭐⭐☆ | Positive rerating bias, investor confidence boost |

| HDFC Bank | ⭐⭐⭐☆☆ | Strategic optional upside, limited risk |

Short-term: IndusInd stock may outperform on sentiment.

Medium-term: Execution will decide sustainability.

Long-term: HDFC remains strategically well-placed if consolidation accelerates.

Final Thoughts

In essence, this isn’t just about shareholding — it’s about institutional signaling.

HDFC Bank’s decision to take a stake in IndusInd Bank hints at growing quiet confidence in India’s financial system and the possible beginning of a new consolidation narrative in the private banking space.

For investors, that’s a space worth watching closely.

FAQs

No. This is only a strategic investment, not an acquisition or merger. HDFC Bank will hold a minority stake without management control.

It’s largely positive — it boosts credibility and could improve valuations if the bank delivers strong financials in the next few quarters.

There’s no official partnership yet, though such strategic connections sometimes evolve into knowledge or technology sharing.

Yes, it adds to growing investor sentiment around potential future consolidation among private banks, as regulatory clarity improves and competition intensifies.

Short-term sentiment looks favorable, but long-term performance will depend on consistent quarterly results and credit quality metrics.