Global central banks entered a synchronized easing phase in December 2025, with the US Federal Reserve cutting rates by 25 bps to 3.5–3.75% and the Reserve Bank of India reducing the repo rate to 5.25% amid record-low Indian inflation and robust 8.2% GDP growth in Q2 FY26. While the Fed faces internal dissent over how much further to cut, the RBI’s unanimous move reflects a rare “Goldilocks” mix of strong growth and soft prices, positioning India as a relative outperformer as the global easing cycle nears its end.

Table of Contents

- Chapter 1: The Synchronized Cut: Fed, RBI, and the World's Central Banks Move in Harmony

- Chapter 2: The December 2025 Rate Cut Marathon: Who Cut, Who Didn't, and Why

- Chapter 3: RBI: A Rare Unanimous Decision for Growth

- Chapter 4: Bank of England: A Cut Coming on December 18

- Chapter 5: ECB: The Outlier Holding Steady (For Now)

- Chapter 6: The Easing Intensity: Who's Cutting Most Aggressively?

- Chapter 7: India's GDP Surprise: 8.2% Growth When Markets Expected 7%

- Chapter 8: What Drove The Beat?

- Chapter 9: The RBI's Response: Upgraded Forecast

- Chapter 10: The Inflation Story: From Crisis to Comfort Zone

- Chapter 11: The Global Divergence: Easing vs Hiking

- Chapter 12: What's Driving The Global Easing Cycle?

- Chapter 13: The "Neutral Rate" Question: Are We Easing or Just Adjusting?

- Chapter 14: What This Means For You: The Three Scenarios

- Chapter 15: RBI's "Goldilocks" Phase: Why India Stands Apart

- Chapter 16: What Happens Next: The 2026 Roadmap

- Chapter 17: The Investment Playbook: December 2025 & Beyond

- Chapter 18: FAQ: Your Burning Questions Answered

The Synchronized Cut: Fed, RBI, and the World’s Central Banks Move in Harmony

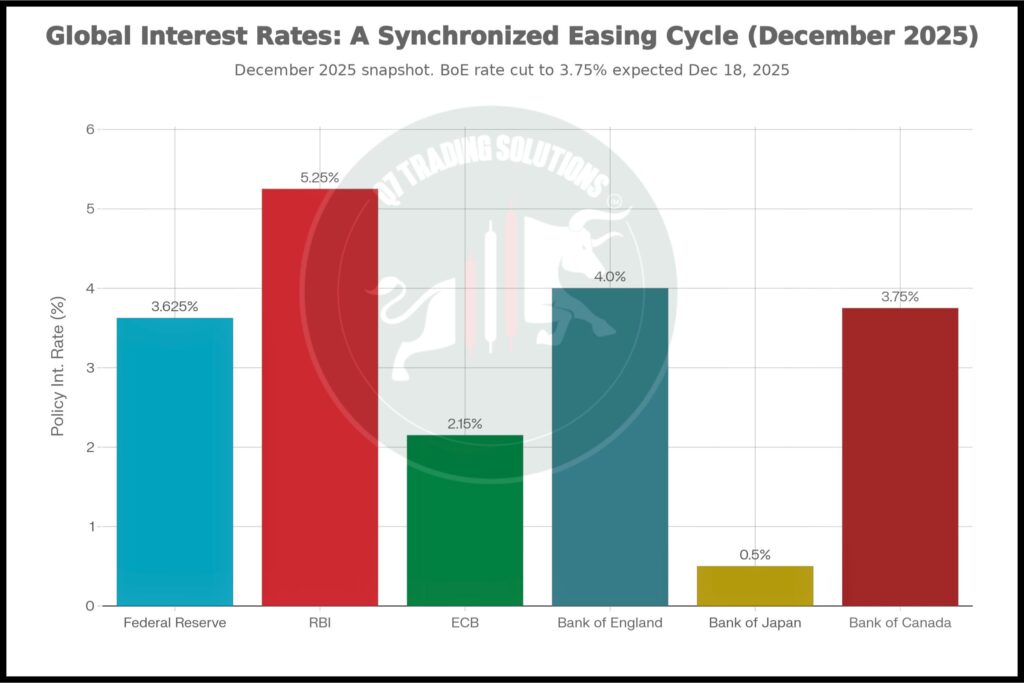

Picture this: On December 10, 2025, the Federal Reserve cut rates. A week earlier, on December 5, 2025, the Reserve Bank of India cut rates. Simultaneously, the Bank of England is expected to cut on December 18, while the ECB holds steady, signaling potential cuts in 2026.

What’s happening? The world’s central banks are engaged in the fastest synchronized rate-cutting cycle outside of a recession in decades. And it’s reshaping how investors think about growth, inflation, and returns in 2026.

This isn’t coincidence. It’s a coordinated global shift driven by one powerful force: inflation finally coming under control, while growth surprisingly holds firm.

Let me break down what’s actually happening, what it means for your money, and why this moment matters more than headlines suggest.

The December 2025 Rate Cut Marathon: Who Cut, Who Didn’t, and Why

Federal Reserve: A Contentious Quarter-Point Cut

On December 10, 2025, the Federal Open Market Committee (FOMC) made its third consecutive rate cut: 0.25 percentage points (25 basis points), bringing the federal funds rate to 3.5%-3.75%.

But here’s what makes this cut different: Three FOMC members dissented—the most significant internal disagreement since September 2019.

What the dissenters wanted:

- One member (Fed Governor Stephen Miran) wanted a more aggressive 0.5% cut (50 basis points)

- Two members (including Atlanta Fed President Beth Hammack) wanted to hold rates steady

This split reflects the Fed’s core dilemma: Should we prioritize the softening job market, or the lingering inflation threat?

Fed Chair Jerome Powell tried to thread the needle in his post-meeting statement, saying the Fed is “well positioned to observe how the economy evolves” and that it’s operating at “higher end of neutral range”. Translation: We’ve probably cut enough for now, but we’re watching closely.

What’s New:

The Fed announced it would resume Treasury purchases starting in January 2026 at $40 billion per month—a significant liquidity injection aimed at stabilizing the financial system amid ongoing uncertainties.

RBI: A Rare Unanimous Decision for Growth

On December 5, 2025, India’s Monetary Policy Committee made a historic decision: unanimously cutting the repo rate by 0.25% to 5.25%.

Unanimous votes are rare in monetary policy. This one signals something crucial: Even the inflation hawks on the MPC agree that growth deserves support.

Why RBI could cut unanimously:

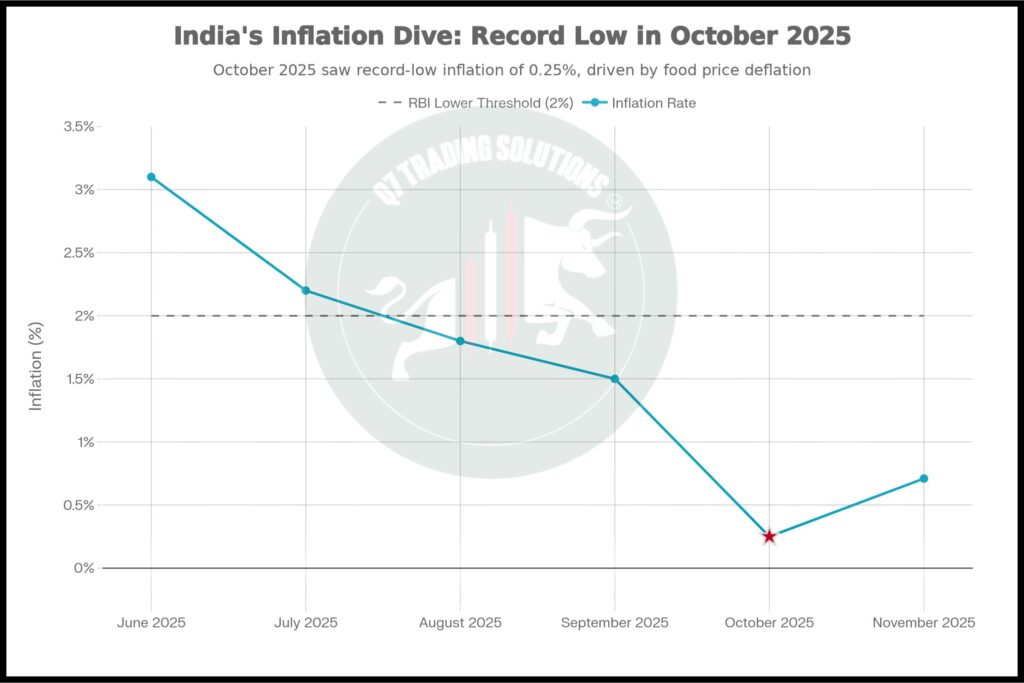

- Inflation collapsed: October 2025 saw a record-low 0.25% inflation, well below the RBI’s 2% lower tolerance threshold

- Growth accelerated: Q2 FY26 GDP at 8.2% (more on this below)

- RBI Governor’s rare admission: Sanjay Malhotra described the economy as being in a “rare Goldilocks phase”—strong growth, soft inflation

What else RBI did:

- Cut Standing Deposit Facility to 5.0% (from 5.25%)

- Injected ₹1 lakh crore ($12 billion) in Open Market Operations (bond purchases)

- Announced $5 billion forex swap operations

Cumulative Impact: The RBI has now cut rates by 125 basis points since February 2025—the most aggressive easing cycle since 2019.

Bank of England: A Cut Coming on December 18

Markets have priced in near-certainty that the Bank of England will cut its Bank Rate by 0.25% to 3.75% on December 18, 2025. Why? British inflation has eased to 3.6% (from 3.8%), unemployment is rising, and markets expect a 5-4 vote split favoring a cut. If the cut happens, it will extend the UK’s easing cycle—which began in August 2024—to a cumulative 150 basis points.

ECB: The Outlier Holding Steady (For Now)

Here’s the interesting contrast: The European Central Bank held rates steady on its December 18 decision, with all 96 economists surveyed expecting it to keep the deposit facility rate at 2.0%. Why? Europe’s inflation remains more sticky at around 2.15%, and the economy shows surprising resilience. ECB President Christine Lagarde hinted the bank might actually upgrade growth forecasts for 2025, suggesting the policy is already working.

Looking ahead: Most economists (80%) expect the ECB to hold rates steady until mid-2026.

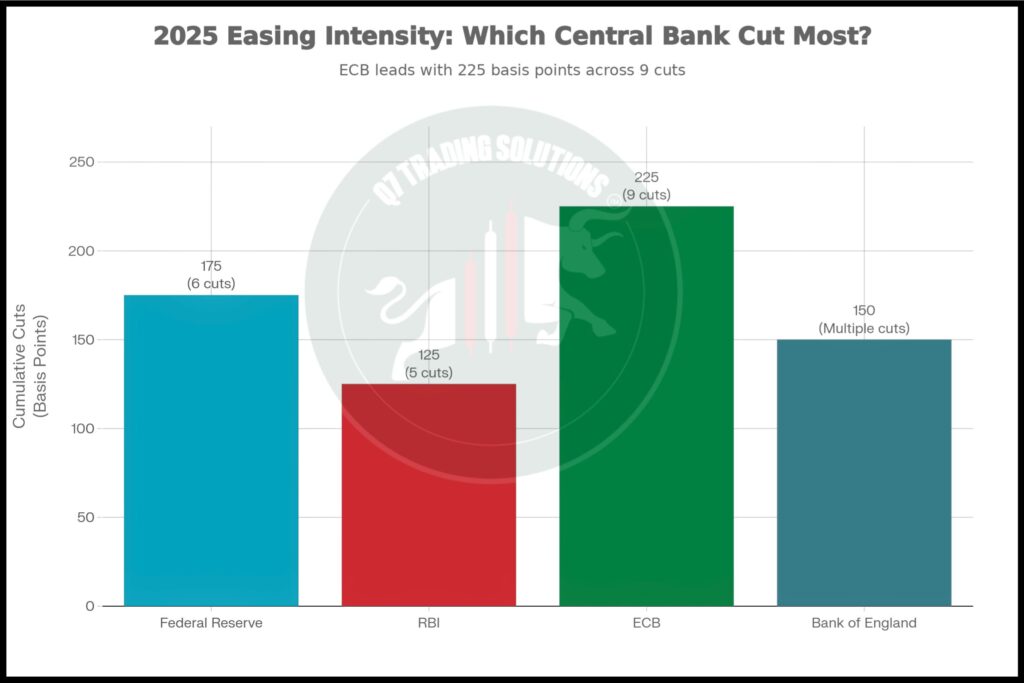

The Easing Intensity: Who’s Cutting Most Aggressively?

To understand the global monetary landscape, you need to see the cumulative impact of 2025 Cumulative Rate Cuts by Major Central Banks:

- ECB: 225 basis points (most aggressive from June 2024-June 2025 cycle)

- Federal Reserve: 175 basis points (6 cuts in 2025 alone)

- Bank of England: 150 basis points (since August 2024)

- RBI: 125 basis points (5 cuts since February 2025)

- Bank of Canada: Holding steady (market expects 35 bps of hikes in 2026)

- Reserve Bank of Australia: Holding steady (market expects 50 bps of hikes in 2026)

The data reveals something critical: Developed economies (US, UK, Eurozone) are easing faster than emerging markets. India is cutting, but not as aggressively as the Fed or ECB. This creates currency and capital flow implications that savvy investors are already positioning for.

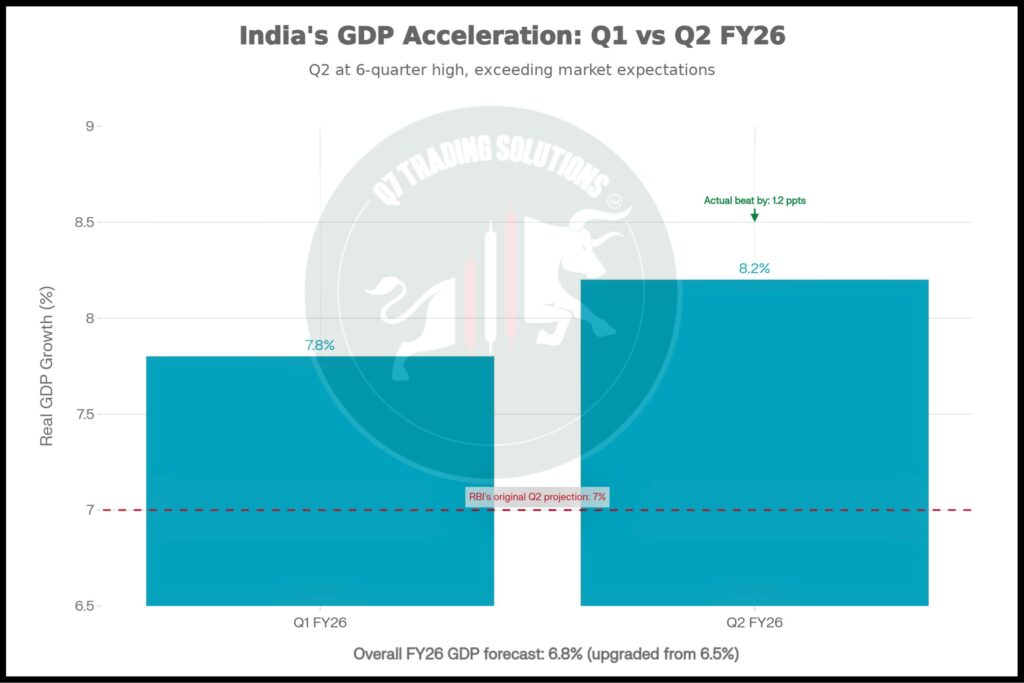

India’s GDP Surprise: 8.2% Growth When Markets Expected 7%

Now here’s where the story gets really interesting for India-focused investors.

On November 28, 2025, India’s Ministry of Statistics released Q2 FY26 (July-September 2025) GDP data, and it shocked most analysts to the upside.

The Surprise:

Real GDP growth in Q2 FY26: 8.2% year-on-year

What analysts expected: 7.0-7.5%

What actually happened: 8.2% (6-quarter high)

This isn’t a marginal beat. This is a 120 basis point surprise to the upside—the kind of number that forces investors to reprice India’s entire growth trajectory.

For context: Q1 FY26 came in at 7.8%. So we’ve got acceleration, not deceleration. India’s growth momentum is building, not fading.

What Drove The Beat?

Manufacturing: +9.1% (the strongest growth component)

Construction: +7.2% (infrastructure momentum)

Financial & Real Estate Services: +10.2% (strong service sector)

Tertiary Sector (Services): +9.2% overall

Even with 50% US tariffs hitting exports (imposed August 27, 2025), India’s domestic demand is so strong that it’s offsetting external headwinds.

What lagged:

Agriculture: +3.5% (seasonal moderation)

But even agriculture held up better than feared given tariff uncertainty

The RBI’s Response: Upgraded Forecast

The RBI originally forecast Q2 FY26 growth at 7.0%. When the 8.2% number landed, RBI Governor Sanjay Malhotra immediately upgraded the full-year FY26 growth forecast to 6.8% (from 6.5%).

This is the RBI saying: “Our baseline for India’s growth just got better.”

Full Year (FY26) Outlook:

- Original RBI forecast: 6.5%

- Revised RBI forecast: 6.8%

- If Q3-Q4 maintain momentum: Could exceed 7.0%

The Inflation Story: From Crisis to Comfort Zone

If strong growth is the good news, the inflation story is even better for central banks. In October 2025, India’s consumer price inflation hit 0.25% year-on-year—the lowest reading on record. To understand how remarkable this is: The RBI’s inflation target band is 2-6%, with a 2% midpoint. Being at 0.25% means inflation was 1.75 percentage points below target.

What caused the collapse?

- Food deflation: Prices actually fell 3.91% YoY in October, driven by:

- Vegetable abundance (harvest cycle)

- Pulses and spices in ample supply

- Seasonal weakness in prices

November 2025: Inflation ticked up to 0.71%, showing some normalization as the seasonal trough passed. But even at 0.71%, inflation remains very subdued.

Global Comparison: US inflation (2.4%), UK inflation (3.6%), Eurozone inflation (2.2%)—all comfortably above India’s 0.71%[Source: Statista: Inflation Rate and Interest Rate by Country 2025].

This low inflation environment gave the RBI the room to cut rates unanimously. With inflation so low, there’s no risk of reigniting price pressures via rate cuts.

The Global Divergence: Easing vs Hiking

Here’s what’s fascinating about the current moment: The world’s central banks are not all moving in the same direction. While the Fed, RBI, ECB, and BoE are all cutting (or expected to cut), some major central banks are preparing to hike:

Central Banks Expected to Hike in 2026:

- Bank of Canada: Expected 35 bps of hikes (vs earlier expectations of cuts)

- Reserve Bank of Australia: Expected 50 bps of hikes

- Central Bank of Russia: Maintaining historically high rates at 16.5%

Why? Canada and Australia are concerned about:

- Sticky inflation (despite global trends)

- Overheating labor markets

- Need to attract foreign capital (interest rate differentials matter)

This divergence creates carry trade opportunities: Investors borrow in low-rate currencies (JPY at 0.5%, EUR at 2.15%) and invest in higher-rate currencies (AUD, CAD, INR at 5.25%).

What’s Driving The Global Easing Cycle?

The synchronized rate-cutting environment isn’t arbitrary. It’s driven by three structural forces:

- Inflation Finally Below Target

All major developed economies have achieved inflation near or below target:- US: 2.4% (Fed target: 2.0%)

- Eurozone: 2.2% (ECB target: 2.0%)

- UK: 3.6% (BoE target: 2.0%, but coming down)

- India: 0.71% (RBI target band: 2-6%)

- Labor Market Softening

US: Job growth has slowed; unemployment is creeping up from pandemic lows

UK: Unemployment is rising; wage growth cooling

Eurozone: Growth is tepid; employment gains modest

Central banks interpret this as: “We need to support employment with lower rates.” - Political Pressure & Fiscal Support

US: Trump administration is planning infrastructure spending and tax cuts (fiscal stimulus)

India: Government accelerated tax reforms and labor law changes

UK: Budget included consumption-boosting measures

When fiscal policy is stimulative, monetary policy can afford to ease (supporting growth), because fiscal provides the “automatic stabilizer” if things slow too much.

The “Neutral Rate” Question: Are We Easing or Just Adjusting?

Here’s an important nuance that separates informed investors from casual observers:

Central banks aren’t necessarily “easing” anymore. They’re “normalizing.”

Fed Chair Powell specifically said the Fed is operating at the “higher end of neutral”.

Neutral means rates are neither stimulating nor restraining the economy.

Why does this matter?

If rates are at neutral, future rate hikes are possible if inflation rebounds. This isn’t a “permanently low rates” regime. It’s a “appropriately balanced rates” regime. For investors: This means:

- Don’t expect unlimited rate cuts in 2026

- Central banks will be data-dependent (inflation scare = pivot back to hawkish)

- The easing cycle is likely ending, not accelerating

What This Means For You: The Three Scenarios

Scenario 1: “Soft Landing” (Base Case 70% Probability)

Conditions:

- Growth remains above 2-3% in developed economies

- Inflation stays stable around 2%

- Central banks complete easing cycle and hold rates steady through 2026

Implications:

- Equities: Small-cap and cyclical stocks outperform

- Bonds: Long-term yields stay low; short-term rates stabilize

- Currencies: Dollar weakens moderately vs commodity currencies (INR, AUD, CAD)

- Commodities: Oil $60-70/bbl, metals stable

Scenario 2: “Growth Recession” (20% Probability)

Conditions:

- Tariff wars (Trump administration) accelerate slowdown

- Global trade collapses; manufacturing contracts

- Central banks forced to cut rates aggressively (emergency easing)

Implications:

- Equities: Flight to safety; mega-cap tech outperforms

- Bonds: Long-term yields crash; duration gives 10-20% returns

- Currencies: Dollar rallies; emerging markets crushed (INR weakens to 90-92)

- Commodities: Oil crashes to $40-50/bbl; gold rallies

Scenario 3: “Stagflation Return” (10% Probability)

Conditions:

- Inflation re-accelerates due to fiscal stimulus + supply shocks

- Central banks trapped; can’t cut without reigniting prices

- Growth stalls despite expensive credit

Implications:

- Equities: Everything struggles; only select inflation-hedge stocks work

- Bonds: Devastating losses; inflation-linked bonds only safe haven

- Currencies: Commodity currencies outperform

- Commodities: Oil rallies to $90+; gold to $2500+

Most Likely (70%): Soft landing, equities rally 10-15% through 2026, rates hold steady after Jan 2026.

RBI’s “Goldilocks” Phase: Why India Stands Apart

RBI Governor Sanjay Malhotra’s description of the Indian economy in a “rare Goldilocks phase” deserves unpacking.

Goldilocks conditions:

🟢 Growth: Strong at 8.2% (just right)

🟢 Inflation: Low at 0.71% (just right)

🟢 Employment: Stable (rural incomes up due to monsoons)

🟢 Capex: Government accelerating infrastructure spending

🟢 Consumption: GST collections, auto sales, strong despite tariffs

The catch:

🔴 External sector: Trade deficit widening due to US tariffs (50% on Indian goods since August 27, 2025)

🔴 FII flows: Foreign investors pulled $16 billion in 2025 due to tariff concerns

🔴 Rupee pressure: Currency at record lows amid capital outflows

So while the domestic story is Goldilocks, the external story is challenged. The RBI is essentially betting that domestic strength (8.2% growth, low inflation) is durable enough to weather tariff headwinds.

The two more expected cuts (December + February 2026) bring the repo rate to 5.0%, giving a clear path to further rate cuts if tariff damage accelerates. But for now, RBI’s stance is: Support growth and liquidity, while monitoring inflation (which is no threat).

What Happens Next: The 2026 Roadmap

December 2025-March 2026: “The Easing Completes”

Likely actions:

- Fed: Possibly one more 25 bps cut (to 3.25-3.5%) by mid-2026; then pause

- RBI: One more 25 bps cut in February; then potentially pause (repo at 5.0%)

- BoE: Likely another 25-50 bps in Q1 2026 (market prices 50 bps more)

- ECB: Likely starts cutting again in Q2 2026 if growth softens

FED Vs RBI: Synchronized Easing, Different Paths (December 2025)

Both cut rates 25 bps but diverge on timing and policy tools

| Policy Metric | Federal Reserve | RBI |

|---|---|---|

| Rate Cut (Dec 2025) | 25 bps | 25 bps |

| New Policy Rate | 3.5–3.75% | 5.25% |

| Cumulative Cuts 2025 | 175 bps (6 cuts) | 125 bps (5 cuts) |

| Committee Vote | 9–3 (3 dissents) | Unanimous |

| Next Cut Expected | Possible in 2026 | February 2026 |

| Policy Stance | Data dependent | Neutral |

| Primary Focus | Employment + Inflation | Growth + Price stability |

| Liquidity Support | $40B Treasury purchases/month | ₹1L cr OMO + $5B FX swap |

April-December 2026: “The Hold Pattern”

Most central banks will likely be in a “wait-and-see” mode:

- Monitor inflation trajectory

- Watch trade data (Trump tariffs impact)

- Assess labor market

- One more cut possible only if recession risks spike

Key Risks That Change The Playbook:

Inflation risk (10% probability): If food prices rebound sharply in Q3-Q4 2026, central banks could pause/reverse cuts. This is especially true for India if food inflation re-accelerates.

Tariff shock (25% probability): If Trump’s tariffs escalate beyond current 50% on Indian goods, export growth could collapse, forcing emergency cuts.

Financial stability shock (5% probability): If credit stress emerges (US commercial real estate, emerging market FX crisis), central banks cut hard and fast.

The Investment Playbook: December 2025 & Beyond

For Indian Investors:

Equity exposure: Maintain high allocation to domestic-demand themes

- Bank stocks (RBI easing = margin expansion)

- Infrastructure (capex acceleration)

- Manufacturing (9.1% growth in Q2, room to expand)

- Consumer discretionary (auto, appliances—benefiting from lower EMIs due to rate cuts)

Avoid:

- Export-heavy sectors (tariff headwind)

- Capital-light business (limited from RBI’s liquidity support)

- Bond exposure: Lock in long-term yields NOW. With RBI cutting, 10-year G-sec yields could compress further (currently around 6.5-6.7%). A 0.5% move saves you 0.5% return.

- Currency: INR likely to remain under pressure (₹84-85 to USD) due to tariff-driven capital outflows, but RBI’s rate cuts and liquidity injections provide support above 85.

For Global Investors:

Tactical overweight India: 8.2% GDP growth + RBI easing + low inflation = compelling risk/reward vs developed markets growing at 2-3%.

Pairs trade: Long India rupee/short US dollar as Fed completes easing cycle.

Bonds: Consider Indian government bonds (6.5% yield + potential capital gains as yields compress).

FAQ: Your Burning Questions Answered

A: Markets have already priced in the cuts (they were expected). Bond prices only soar on unexpected easing (surprises). The December cuts were consensus calls, not surprises. However, bond investors have locked in yields around 3.5-4.0% in developed markets—excellent long-term returns if recession hits.

A: Not necessarily from rate cuts alone. Rate cuts are already priced into valuations. What drives rallies are:

- Growth exceeding expectations (India 8.2% beat),

- Inflation staying low (India 0.71%),

- Earnings growth (Challenged by tariffs).

The 8.2% GDP was the actual rally catalyst, not the rate cut.

A: Unlikely many more cuts. Powell signaled the Fed is “well positioned” at current rates. Markets price ~75 bps of cuts for ALL of 2026 (only 3 cuts). This is very different from 2024 (175 bps of cuts). The Fed’s hiking cycle is over, but aggressive easing is also over.

A: The RBI has the most room to cut because:

- Inflation is record-low (0.25-0.71% vs 2% target),

- RBI hasn’t cut since October 2024 (unlike Fed cutting constantly),

- Growth remains robust (8.2%) so cuts won’t overheat the economy.

Other central banks can’t cut as much because inflation hasn’t fallen as far.

A: Bank lending rates will eventually fall by 50-75% of the RBI cut. So a 25 bps RBI cut = 12-18 bps cut on your home loan within 1-2 months. On a ₹50 lakh home loan, this saves ~₹600/month in EMI. However, banks are slow to pass on cuts in full, so don’t expect immediate changes.

A: YES, but strategically. Lock in 10-year bond yields (6.5-6.7% in India) because as the easing cycle completes, yields will likely compress to 6.0-6.2%, giving you 0.3-0.5% capital gains. This is attractive in a low-rate environment. 3-year bonds are less attractive (yields around 6.2%, limited upside).

Conclusion: The Easing Cycle Completes, But Growth Stays Strong

December 2025 marks a watershed moment: The global panic-easing cycle that began in mid-2024 is nearing completion. The Fed, RBI, BoE, and ECB have collectively cut rates by cumulative 575+ basis points. For investors, the key insight is this: Rate cuts are not the growth story anymore. The growth story is the growth story.

India’s 8.2% GDP beat proves it. The US economy’s resilience despite rate hikes in 2023-2024 proved it. The Eurozone’s economic strength despite crises proved it.

Entering 2026:

- Central banks will mostly hold rates steady

- Growth will be the performance differentiator (India’s 8% vs developed markets’ 2%)

- Inflation will likely stay stable (no major deflation or acceleration fears)

- Investors should rotate from “bond outperformance” back toward “growth equities”

For India specifically: The RBI has given you a clear signal—the domestic economy is strong enough to justify easing, inflation is benign enough to justify easing, and the path forward involves supporting that growth with lower rates.

That’s not a warning. That’s an opportunity.

Data Sources & Methodology

This analysis draws from:

Federal Reserve:

- FOMC Meeting Press Release (December 18, 2024) – federal funds rate decision

- Fed Chair Jerome Powell’s Press Conference (December 18, 2024) – policy stance

- Federal Reserve Board announcements – Treasury purchase resumption[Ref 1][Ref 2]

Reserve Bank of India:

- RBI Monetary Policy Committee Decision (December 5, 2025) – repo rate cut, stance

- RBI Governor Sanjay Malhotra’s speech (December 5, 2025) – “Goldilocks” commentary

- RBI’s monetary policy press release – inflation, growth, liquidity measures[Ref 1][Ref 2][Ref 3]

Indian Economic Data:

- Ministry of Statistics & Programme Implementation – Q2 FY26 GDP data

- National Statistical Office (NSO) – Real GVA and nominal GDP estimates

- MOSPI – Inflation data (October-November 2025)[Ref 1][Ref 2][Ref 3]

Global Central Banks:

- ECB interest rate decisions and press releases – deposit facility rate[Ref 1][Ref 2]

- Bank of England MPC minutes and Reuters poll projections[Ref 1][Ref 2]

- Bank of Japan policy decisions – current 0.5% rate[Ref 1]

- Reserve Bank of Australia, Bank of Canada policy statements[Ref 1]

Global Interest Rate Compilation:

- Trading Economics global central bank rates database[Ref 1]

- CBRates.com central bank rates comparison[Ref 1]

- Reuters monetary policy polls (multiple dates Dec 2025)[Ref 1][Ref 2]

Methodological Notes:

- Inflation data: Consumer Price Index (year-on-year percentage change)

- GDP growth: Real GDP (constant prices), year-on-year percentage change

- Rate cuts: Measured in basis points (1 bps = 0.01%)

- Currency impacts: Assessed via interest rate differentials and capital flow patterns

- All dates in December 2025 current as of publication

About Q7 Trading Solutions

At Q7 Trading Solutions, we synthesize global monetary policy decisions, economic data, and market implications into actionable insights for traders, investors, and businesses. Our research combines central bank communications, macroeconomic statistics, and empirical market analysis to help you navigate complex financial transitions with confidence.

Disclaimer: This article is based on published central bank decisions, official government statistics (as of December 2025), and expert analysis. Economic data is subject to revision. This is educational analysis, not investment advice. Consult a financial advisor before making investment decisions. Past monetary policy doesn’t guarantee future results.