Summary:

India’s November 2025 GST collections stood at ₹1.7 trillion, reflecting a modest 0.7% year-on-year increase despite significant GST rate cuts. This resilience signals strong consumption, formal economy growth, and rising tax compliance. Lower GST revenues post-rate cuts are a positive sign, creating liquidity expansion, easing inflation, and paving the way for a likely multi-week equity rally particularly benefiting midcaps, infrastructure, metals, and consumption sectors.

Table of Contents

- Chapter 1: Understanding the November GST Numbers

- Chapter 2: Why Lower GST Collections Are Actually Bullish

- Chapter 3: Sectors Primed for Growth Post-GST Reform

- Chapter 4: What Retail Traders Will Miss and Q7’s Edge

- Chapter 5: Preparing for the December-January Rally

- Chapter 6: The Time to Act is Now

- Chapter 7: FAQs

India reported ₹1.7 trillion in GST collections for November 2025, a modest 0.7% rise year-on-year. At first glance, retail investors may view this as a sign of economic slowdown. However, a deeper analysis reveals the exact opposite: this GST number is a bullish indicator signaling strong consumption resilience, inflation easing, and a liquidity-driven rally in key sectors.

Understanding the November GST Numbers

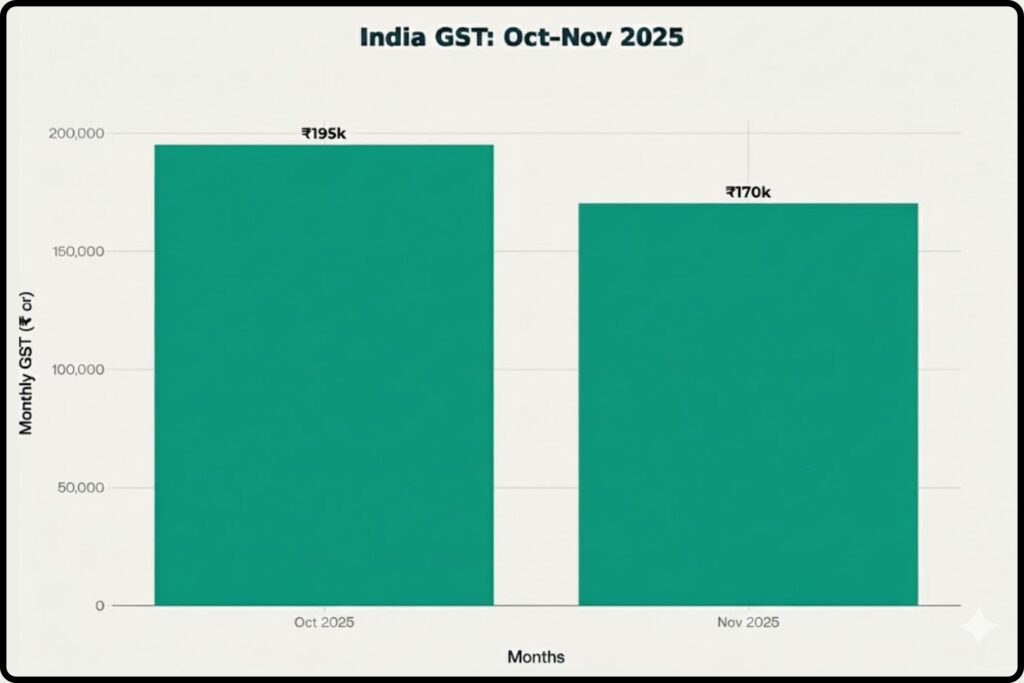

- November GST collections stood at ₹1,70,276 crore, up 0.7% YoY but down from October’s ₹1.95 lakh crore.

- Cumulative GST collections for April-November grew 8.9% year-on-year to ₹14.75 lakh crore.

- GST rate cuts effective from late September 2025 lowered rates on 375 items, simplifying slabs to mainly 5% and 18%, with a 40% bracket for luxury goods.

- Despite the tax rate cuts, collections remain robust, highlighting broad-based consumption growth and high tax compliance.

Why Lower GST Collections Are Actually Bullish

1. Tax Cuts Trigger Economic Resilience

The government’s biggest GST overhaul cut tax rates significantly, expected to reduce annual revenue by about ₹93,000 crore. Yet collections at ₹1.7 trillion despite these cuts indicate:

- Strong Consumer Demand: Lower prices from cuts increase buying power.

- Expanding Formal Economy: More businesses are compliant under GST.

- Healthy Consumption Despite Lower Tax Rates: Volume growth offsets reduced rates.

2. Inflation Softening and RBI Policy Space

GST cuts directly lower prices on essential items, contributing to RBI’s lowered inflation forecast of 2.6% for FY26. This soft inflation gives RBI room for further interest rate cuts, adding liquidity and boosting market sentiment.

3. Liquidity Expansion Drives Market Upside

Lower GST revenues signal the government will stimulate growth via increased infrastructure spending and PSU capital expenditure, providing:

- More liquidity in banking and financial systems

- Expansion in government-capex fueled sectors

- A conducive environment for PSU, infrastructure, and metal rallies

4. Import GST Growth Shows Investment Momentum

Import GST collections rose 10.2% YoY, reflecting robust demand for raw materials and capital goods, signaling healthy corporate capex cycles that often precede equity rallies.

5. Why FIIs Will Buy the Dip

Foreign Institutional Investors prefer stable inflation, lower tax pressure, and central bank easing—all aligned with the GST 2.0 reforms. This environment typically triggers 4-6 week rallies in equities, especially mid and smallcaps.

Sectors Primed for Growth Post-GST Reform

| Sector | Why It Benefits | Trading Edge |

|---|---|---|

| FMCG & Consumer Discretionary | Lower GST margins boost volumes and profits | Resilient largecaps, high-growth midcaps opportunity |

| Metals & Commodities | Cost reduction + infrastructure spending | Early leverage on commodity rallies |

| Infrastructure & PSU | Government spending + liquidity expansion | Multi-month outperformance potential |

| Small & Midcaps | First beneficiaries of liquidity shifts | High volatility, high reward setups |

What Retail Traders Will Miss and Q7’s Edge

Retail traders often panic sell on low GST headlines, mistaking tax cut effects for economic weakness. Meanwhile, Q7tradingsolutions uses data-driven, systematic approaches to:

- Track institutional liquidity shifts

- Identify sectors benefiting from macro policy pivots

- Capitalize on breakout structures in mid and smallcaps

- Ride multi-week rallies triggered by strong fundamentals

Preparing for the December-January Rally

Historically, December-January rallies are fueled by bonus liquidity, SIP inflows, and fiscal year-end capex. The current GST-driven liquidity environment enhances these factors, promising significant upside for early traders.

The Time to Act is Now

Lower GST collections post-rate cuts are a bullish market signal, not a warning. This is a classic liquidity expansion event leading to rallies in midcaps, metals, infrastructure, and consumption sectors. Retail panic tomorrow will create entry points for those who know how to read the data.

Q7tradingsolutions invites traders to position before the market opens tomorrow and capture this liquidity-driven January rally.

FAQ

This figure reflects strong consumption resilience despite GST rate cuts. It signals expanding formal economy, rising tax compliance, and a liquidity boost that often precedes rallies in midcaps and PSU stocks.

GST rates were reduced in September 2025 under GST 2.0 reforms, lowering taxes on 375 items to enhance affordability. Collections held steady at ₹1.70 lakh crore due to resilient consumer demand, improved compliance, and volume growth offsetting lower rates

Sectors like FMCG (daily goods), metals, infrastructure, and government companies (PSUs) benefit the most. Lower taxes mean consumers can spend more, and companies can invest more, driving growth in these areas.

FIIs prefer stable/soft inflation, lower indirect taxes, and central bank easing. The November GST data checks these boxes, making India attractive for fresh FII equity inflows over 4–6 week rally periods.

GST 2.0 reforms cut several tax slabs, easing inflation and creating room for RBI rate cuts. This triggers liquidity expansion, leading to favorable conditions for infrastructure, metal, and consumption sector rallies.

Lower tax pressure combined with consumption growth and increased government capex encourages institutional inflows into mid and smallcaps, where liquidity expansion first shows up, often leading to outsized gains.