Lenskart IPO 2025 opens on October 31, 2025, with a price band of ₹382-₹402 per share, targeting a valuation of ₹70,000 crore ($8 billion). While IPOs offer early entry into high-growth companies, research shows they can be overpriced due to promoter interests and market hype. Investors face a crucial decision: buy at IPO for potential listing gains or wait for post-listing stability. This article explores both strategies, Lenskart’s fundamentals, and whether IPO manipulation concerns should influence your investment decision.

Table of Contents

- Chapter 1: The Lenskart Success Story

- Chapter 2: What is an IPO and Why Do Companies Launch Them?

- Chapter 3: The Big Question—Are IPOs Overpriced?

- Chapter 4: The Lenskart IPO—What You Need to Know

- Chapter 5: Should You Buy Lenskart at IPO or Wait?

- Chapter 6: Lenskart’s Strengths and Risks

- Chapter 7: The Verdict—What Should You Do?

- Chapter 8: Conclusion: The Choice Is Yours

- Chapter 9: FAQs

Imagine walking into a shop where the owner is selling something for the first time. The shop is decorated beautifully, there are crowds gathering, and everyone is talking about how amazing this product is. The owner says, “This is the best price you’ll ever get! Buy now!” But here’s the question: Is the owner setting the price because it’s fair, or because he wants to make the most money possible?

This is exactly what happens when a company launches an IPO (Initial Public Offering). And right now, one of India’s most talked-about IPOs is about to hit the market: Lenskart Solutions Limited.

Let’s explore this story together—the story of Lenskart’s IPO, the questions around IPO pricing, and the big decision you need to make: Should you invest right at the launch, or should you wait and watch?

The Lenskart Success Story

Lenskart started in 2008 as a simple idea by Peyush Bansal (yes, the same person you see on Shark Tank India!). The idea was simple: make buying eyeglasses easier, cheaper, and more stylish. Before Lenskart, buying glasses meant visiting an optical shop, trying limited frames, and paying high prices.

Peyush changed all that. He created an online platform where you could browse thousands of frames, use a virtual try-on feature, and get glasses delivered to your doorstep. Today, Lenskart operates over 2,700 stores across India and other countries. It manufactures its own frames and lenses in a massive facility in Bhiwadi, Rajasthan.

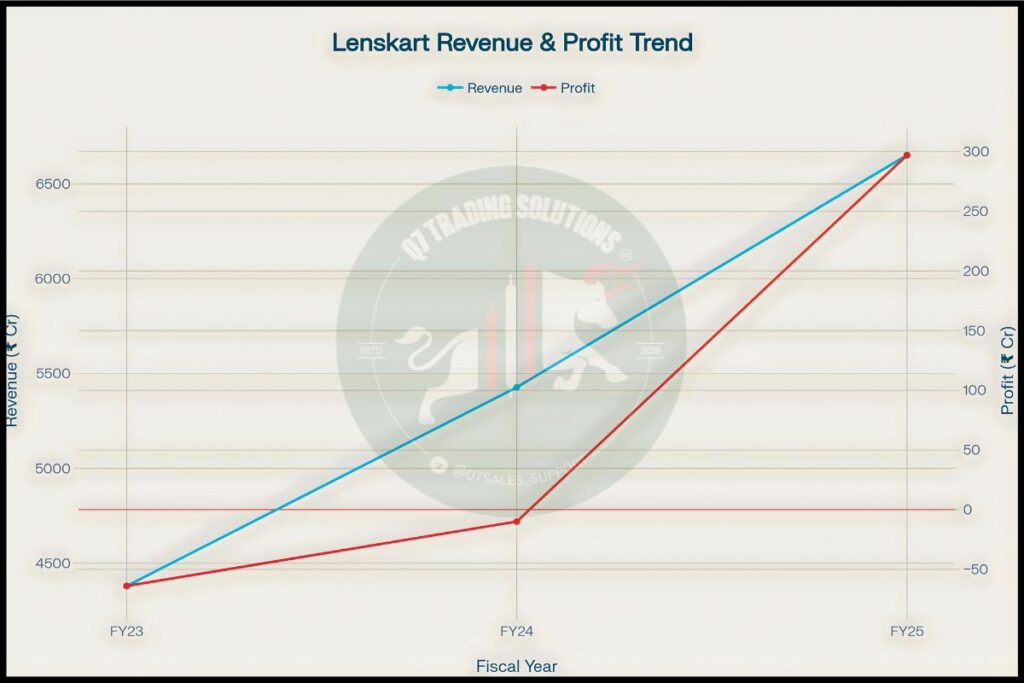

The company’s revenue grew from ₹4,380 crore in FY23 to ₹6,652 crore in FY25—a 32.5% annual growth rate. Most importantly, after years of losses, Lenskart became profitable in FY25 with a net profit of ₹297 crore.

Big investors like SoftBank, KKR, Temasek, and even retail billionaire Radhakishan Damani (founder of D-Mart) have invested in Lenskart, bringing its valuation to about $7.7 billion.

Now, Lenskart wants to go public. It’s launching an IPO to raise ₹7,278 crore—partly to fund expansion (620 new stores), upgrade technology, and boost marketing.

What is an IPO and Why Do Companies Launch Them?

Before we dive deeper, let’s understand what an IPO actually means.

When a company is private (like Lenskart was until now), only a few people—founders, early investors, and employees—own shares. But when it goes public through an IPO, anyone can buy shares and become a part-owner of the company.

Why do companies launch IPOs?

- To raise money: Companies use this money to grow—open new stores, invest in technology, pay off debts, etc.

- To give early investors an exit: Investors who put money in years ago (like SoftBank in Lenskart’s case) can now sell their shares and make profits.

- To increase brand visibility: Going public makes a company more credible and well-known.

In Lenskart’s case, the IPO includes:

- Fresh issue: ₹2,150 crore (new shares being created)

- Offer for Sale (OFS): ₹5,128 crore (existing investors selling their shares)

This means most of the money will go to existing investors, not to the company itself.

The Big Question—Are IPOs Overpriced?

Now comes the tricky part. Are IPOs fairly priced, or are they intentionally overpriced?

Think about it: When the promoter (original owner) wants to sell shares, what’s his goal? To get the highest possible price, right? It’s human nature.

Investment banks help set the IPO price by looking at the company’s financials, growth, and comparing it to similar companies. But here’s the catch: The promoter and investment banks have an incentive to price the IPO as high as possible.

Evidence of IPO Manipulation

Research shows that during the late 1990s dot-com boom, many IPOs were manipulated through tactics like “tie-in agreements,” where underwriters artificially inflated demand. These IPOs showed massive first-day gains (115% median return for manipulated IPOs vs. 16% for normal ones) but crashed later, underperforming by huge margins over the next 6-12 months.

Even without outright manipulation, IPOs tend to be overvalued because:

- Hype and Stories: IPOs are marketed heavily. Media coverage, analyst recommendations, and FOMO (fear of missing out) drive demand.

- Anchoring Bias: The price band set by the company becomes an “anchor” in investors’ minds, making them believe it’s reasonable even if it’s not.

- Promoter’s Interest: The promoter wants maximum money, so they’ll push for the highest valuation they can justify.

Counter-Argument: Are All IPOs Bad?

Not necessarily. Some IPOs are fairly priced and become great long-term investments. Companies with strong fundamentals, profitability, and sustainable growth can reward early investors. The key is distinguishing between hype and genuine value.

To dive deeper into whether you should invest in an IPO or wait and buy the stock later, check out “IPO vs Stock: Which Is the Better Investment Option for You? “

The Lenskart IPO—What You Need to Know

Let’s look at the specifics of the Lenskart IPO:

IPO Parameter Details

| Parameter | Details |

|---|---|

| Opening Date | October 31, 2025 |

| Closing Date | November 4, 2025 |

| Price Band | ₹382 – ₹402 per share |

| Lot Size | 37 shares |

| Minimum Investment | ₹14,874 (at upper band) |

| Total Issue Size | ₹7,278 crore |

| Valuation | ₹70,000 crore (~$8 billion) |

| Listing Date | November 10, 2025 |

Grey Market Premium (GMP)

The Grey Market Premium is an unofficial indicator of expected listing gains. As of October 27, Lenskart’s GMP was around ₹68-75, suggesting the stock might list around ₹477 (an 18.6% gain from the upper price band of ₹402).

However, GMP is speculative and not guaranteed.

Use of Funds

Lenskart plans to use the ₹2,150 crore fresh issue for:

-

Opening 620 new stores

-

Technology and cloud infrastructure upgrades

-

Marketing and brand promotions

-

Potential acquisitions

Should You Buy Lenskart at IPO or Wait?

This is the million-dollar (or ₹70,000 crore) question. Let’s explore both scenarios.

Scenario 1: Buy at IPO (The Early Bird Approach)

Pros:

-

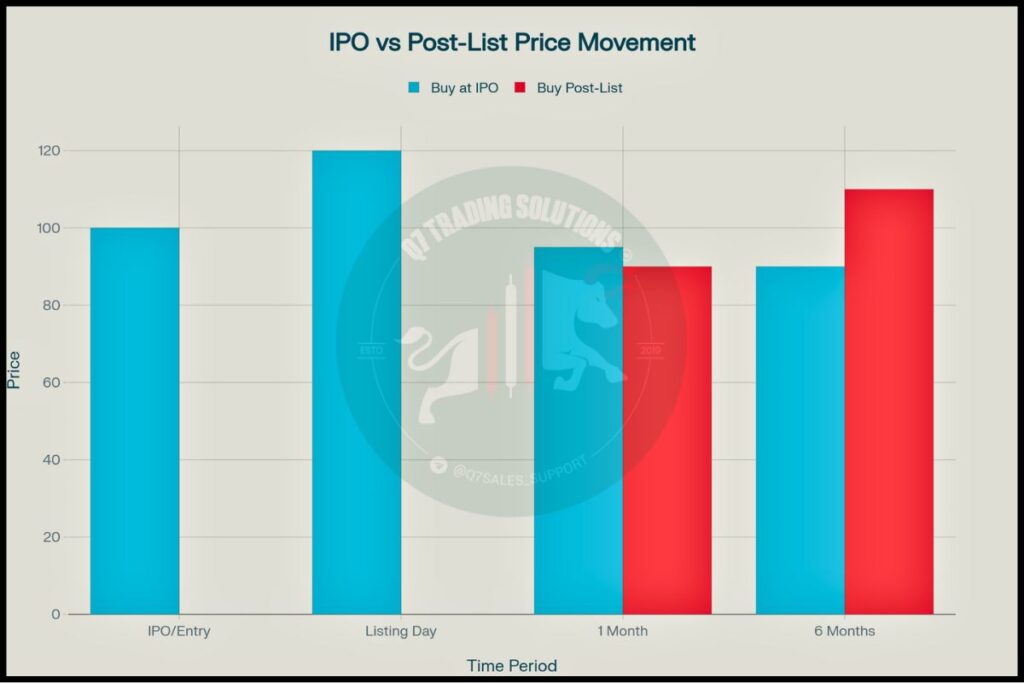

Potential Listing Gains: If GMP predictions are accurate, you could see 15-20% gains on listing day.

-

Early Entry: You get in at the “official” price before the market determines the real value.

-

Long-term Growth Story: Lenskart has strong fundamentals—growing revenue, profitability, and a large addressable market (India’s eyewear market is growing rapidly).

Cons:

-

Overvaluation Risk: At ₹70,000 crore valuation, Lenskart’s price-to-earnings (P/E) ratio might be stretched. The company only became profitable recently.

-

Post-Listing Volatility: Many IPOs see a “pop” on listing day, followed by a correction as reality sets in. Remember, most of the issue is an OFS (existing investors exiting), not fresh capital for growth.

-

Hype Factor: Media and FOMO can drive irrational pricing. The question is whether ₹402 per share truly reflects Lenskart’s intrinsic value or just market euphoria.

Scenario 2: Wait for Post-Listing Correction (The Patient Approach)

Pros:

-

Better Entry Price: Many IPOs correct 10-30% within the first few months as hype fades and fundamentals take over.

-

More Information: Post-listing, you’ll have quarterly results, analyst reports, and real market sentiment to guide your decision.

-

Avoid Manipulation: By waiting, you sidestep potential first-day manipulation and overvaluation.

Cons:

-

Miss Listing Gains: If the stock continues to rally, you might end up buying at a higher price than the IPO.

-

Opportunity Cost: While waiting, your capital remains idle instead of potentially growing.

What Does Research Say?

Studies show that IPOs tend to underperform the broader market in the long run (6-12 months post-listing), especially those with high first-day gains driven by hype. Manipulated IPOs, in particular, show massive reversals after initial euphoria fades.

However, quality companies with strong fundamentals can buck this trend.

Lenskart’s Strengths and Risks

Strengths:

-

Market Leadership: Lenskart is India’s largest eyewear retailer with strong brand recall.

-

Integrated Business Model: From manufacturing to retail, Lenskart controls its entire value chain.

-

Profitability: After years of losses, the company turned profitable in FY25.

-

Tech-Driven: Virtual try-on, AI-powered recommendations, and omnichannel presence give it an edge.

-

Expansion Potential: Plans to add 620 stores show aggressive growth ambitions.

Risks:

-

Competition: Titan Eye+, SpecsMakers, and global brands pose threats.

-

Valuation: At $8 billion, Lenskart’s valuation might already price in years of future growth.

-

Promoter Dilution: Founders and early investors are selling significant stakes, which can be a red flag.

-

Discretionary Spending: Eyewear is not essential spending; economic slowdowns could hurt demand.

The Verdict—What Should You Do?

Here’s the truth: There’s no one-size-fits-all answer. It depends on your risk appetite, investment horizon, and belief in Lenskart’s story.

If You’re Bullish on Lenskart:

-

Apply for the IPO but allocate only a portion of your capital.

-

If you miss the IPO, wait for the first correction (usually within 3-6 months) to enter.

If You’re Cautious:

-

Skip the IPO. Wait for 2-3 quarters of post-listing performance.

-

Monitor quarterly results, management commentary, and analyst ratings.

-

Buy only if the stock corrects to a more reasonable valuation.

If You’re Risk-Averse:

-

Avoid the IPO entirely. Stick to established, profitable, and fairly valued stocks.

-

Remember: Missing one IPO won’t make or break your portfolio, but buying an overvalued one might.

For a deeper comparison between IPO investing and buying listed stocks, read our comprehensive article: IPO vs Stock: Which Is the Better Investment Option for You?

Conclusion: The Choice Is Yours

The Lenskart IPO is exciting—there’s no doubt about it. The company has a compelling growth story, strong fundamentals, and a visionary founder. But as with all IPOs, the question isn’t just “Is the company good?” but “Is the price right?”

History shows us that IPOs can be overpriced due to promoter interests, market hype, and psychological biases. But it also shows that great companies eventually reward patient investors.

So, whether you buy at the IPO or wait for a better entry point, make sure your decision is based on research, not emotion. After all, investing is a marathon, not a sprint.

What will you choose? The early bird approach or the patient strategy? The answer lies in understanding your own financial goals and risk tolerance.

FAQs

The Lenskart IPO opens on October 31, 2025, and closes on November 4, 2025, with listing expected on November 10, 2025.

The price band is set at ₹382-₹402 per share, with a minimum lot size of 37 shares (₹14,874 minimum investment at the upper band).

Research suggests many IPOs are overpriced due to promoter interests, market hype, and psychological biases like anchoring. Manipulated IPOs show high first-day returns but underperform long-term.

It depends on your risk appetite. Buying at IPO offers potential listing gains but carries overvaluation risk. Waiting allows you to assess post-listing performance and enter at potentially better prices.

As of October 27, 2025, Lenskart’s GMP was around ₹68-75, suggesting a potential listing price of ₹477 (18.6% gain). However, GMP is unofficial and not guaranteed.