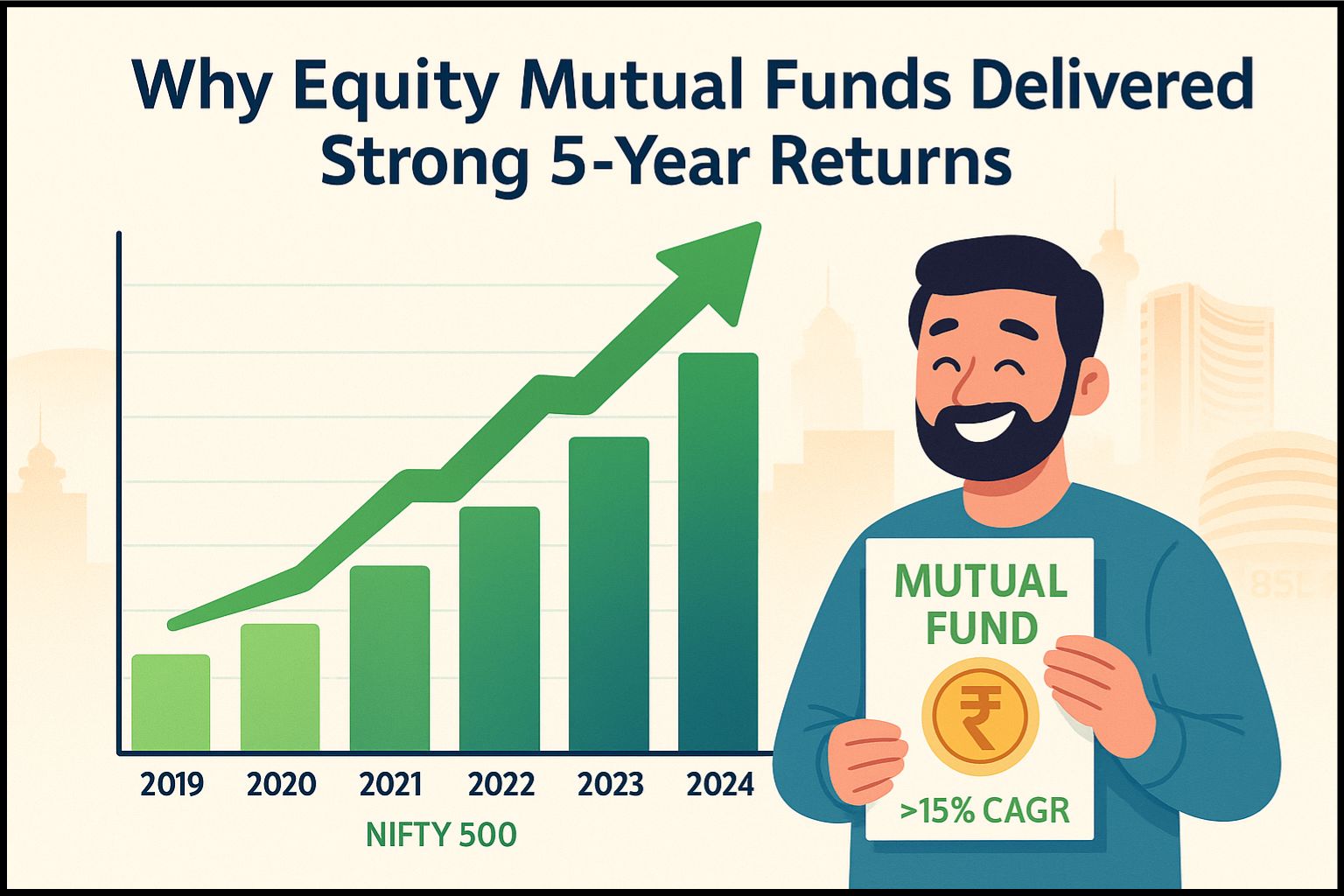

Have you noticed how so many equity mutual fund (MF) and PMS portfolios have been outperforming lately? It’s not just hype—it’s real, and it’s backed by one simple thing: corporate profit growth.

A chart from ICICI Prudential AMC shows that 385 companies out of Nifty 500 delivered more than 15% CAGR over the last 5 years—the highest since records began. That’s a big jump from:

- 335 in 2023

- 256 in 2014

- 77 back in 2013 during the slowdown

That’s why equity MF and PMS portfolios are looking great right now—and here’s why that matters to you.

1. Markets Follow Profits, Not Hearsay

Warren Buffett once said,

“Price is what you pay. Value is what you get.”

When companies grow their earnings consistently, their real-world value shines through—no matter what the stock price says today.

Those 385 companies growing at 15%+ are the backbone of many MF and PMS schemes. As their profits climbed, so did their stock prices—making these investment vehicles perform spectacularly well.

2. The Power of Staying Invested

Let’s do the math in simple terms:

- A 15% annual return doubles your money in about 5 years.

- If that growth sustained for 5 years, it’s no surprise investors saw 2x returns across many portfolios.

But markets aren’t always on a smooth climb—there were dips, corrections, and news shocks. Still, the key was staying invested. Quitting during a dip often means missing the bounce back.

3. Why 2023 and 2024 Were Special

The post-pandemic recovery saw earnings soar across sectors—IT, pharma, finance, manufacturing, consumer goods—you name it. By 2023, 335 companies in the Nifty 500 reached 15%+ CAGR.

In 2024, India’s macro picture became even stronger:

- Economy expanding

- Digital India, infrastructure growth

- A stable government committed to reforms

That ecosystem pushed the number to 385 by the end of the year.

“Markets are slaves of earnings.” This was true in 2013 (when only 77 were shining) and even more so in 2024, when profits soared.

4. How MFs and PMS Benefit You

Most retail investors don’t have the time to pick winners on their own. That’s where professionally managed portfolios like MFs and PMS help:

- Research: Fund managers pick top companies based on deep analysis

- Diversification: You get exposure to a wide range of profitable stocks

- Risk management: Your investment isn’t locked into one or two risky bets

The result? A well-constructed MF or PMS automatically captures that 385-company premium, boosting your returns.

5. Investing Smart: Tips for Long-Term Gains

Here’s what you can do to be part of the success story:

- Look at performance over 5–7 years, not just 6 months.

- Check how many underlying stocks are growing, not just the fund return.

- Understand risk levels—small-cap or mid-cap funds can offer high growth but with higher volatility.

- Stick through short-term bumps—don’t panic on dips, like we saw in 2020 or 2022.

And remember: consistent investing under disciplined fund management is often more powerful than trying to time the market.

6. The Big Message

That ICICI Prudential chart—showing 385 outperforming Nifty 500 firms—says something loud and clear:

Corporate profits matter most in the long game, and patience + conviction = wealth.

Bonus: Want to See This in Action?

We’ve been following this trend closely, and it aligns with what some of our top-performing PMS-style algorithms have done. They watch for profit growth, trend earnings data, and let those signals drive stock picks. When you ride that wave, your portfolio grows with the companies—steady and strong.

Real Talk for Indian Investors

India’s growth story is far from over. With more than 70% of Nifty 500 companies delivering 15%+ CAGR, equity investing looks promising. Just remember:

- Stay invested long term

- Choose funds with consistent earnings focus

- Ignore noise, and track the fundamentals

When you do that? You’ll see portfolios smiling, not sweating.

So, the next time someone wonders “Why are so many mutual funds and PMS performing so well?”—you can answer:

It’s the profit engine—pure and simple.

Ready to check your portfolio’s health? Ask your fund provider to share the CAGR of their top 500 stocks over the past 5 years. You’ll quickly see how many are riding that 15%+ growth wave.

Want a deeper dive into portfolio choices or want us to explore this with your investments? Talk to our team.