Welcome to the very first edition of Q7 AlgoStories, a series where I break down real-life trades executed by our AI-powered Algo—Q7 AlgoFut. This isn’t just about numbers and charts. It’s about the stories behind the scenes—the timing, the markets, the emotions, and of course, the cold-blooded precision of AI.

And today’s story? How Q7 caught an 8% move in MFSL JUL FUT during one of the market’s most uncertain phases—and exited right at the top.

Entry: May 29th – The Calm Before the Surge

The markets weren’t looking too friendly. On May 29th, the Sensex had been struggling, caught between global inflation fears and RBI policy uncertainties. Investors were cautious. Most traders were sitting on the sidelines.

But Q7 wasn’t.

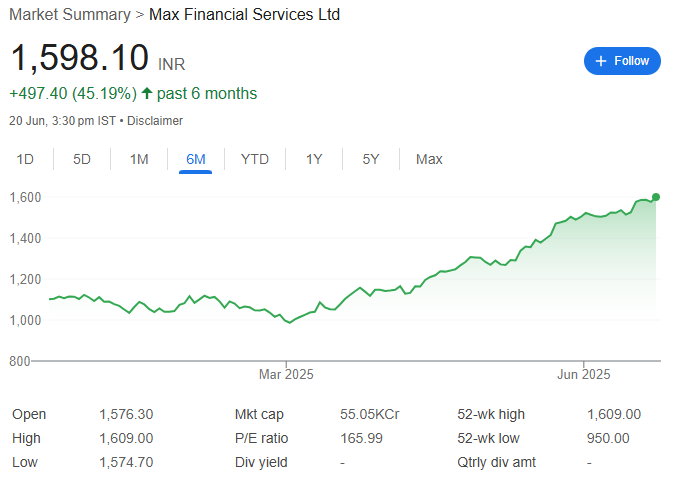

At around ₹1,475, our algo detected an early breakout signal in Max Financial Services Ltd (MFSL)—a large-cap financial stock with solid fundamentals and great institutional backing. While human traders were doubting the market, Q7 was executing.

Why MFSL?

Max Financial Services Ltd (MFSL) is an insurance-holding giant—part of the Max Group—managing 87% of Max Life Insurance, India’s leading non-bank private life insurer. Not only does the company boast a strong market cap (~₹52k Cr), but it also delivered over +61% returns in the past year —making it prime for breakout setups. With a strong track record and a growing digital presence, the stock had been consolidating for weeks—and our AI sensed the perfect storm for a breakout.

Ride: The 8% Rally We Didn’t Miss

As the first week of June rolled in, MFSL’s breakout went full throttle. Over the next 10–12 trading sessions, the stock steadily climbed to ₹1,600+.

The Sensex moved modestly during this period, gaining about 2–3%. But MFSL? It surged 8%, breaking resistance levels one after the other.

Q7’s algo didn’t just buy and pray. It analyzed real-time volume, price action, and sectoral flows. Insurance stocks were gaining momentum, and foreign institutional investors (FIIs) were quietly pumping capital into financials.

Our ALGOFUT entered just before the massive breakout and never looked back.

Exit: June 18th – Profits Locked at the Peak

By June 18th, MFSL hit a lifetime high of around ₹1,605. Q7’s trailing logic kicked in. It recognized topping candles, weakening intraday volume, and loss of momentum.

No emotion. No greed. Just ₹96,000 in clean profit, secured and booked.

Market Context During the Trade

- Sensex: Rebounded from 74,500 to 76,200+ between May 29 and June 18, showing a cautious bullish trend.

- FII Activity: Net buyers in June, especially in financials and insurance.

- MFSL Fundamentals: 61% YoY return, strong earnings outlook, high FII/MF holding (combined 85%+).

This trade wasn’t random. It was a perfect match of technical breakout + fundamental strength + positive market flows. Q7 saw it before most traders even blinked.

What This Trade Proves About Q7’s Algo?

- Predictive Precision – It entered before the breakout actually happened.

- Adaptability – It adjusted to intraday volatility and didn’t get shaken out.

- Emotional Discipline – Exited at the right moment, without hoping for more.

- Speed – Zero delay in reacting to market conditions.

Why This Series Matters to You

As a Gen Z or millennial investor, you’re already more digital than any previous generation. But the markets? They can still be ruthless. Q7’s AI isn’t a magic wand—it’s a smart assistant that helps you catch moves that others miss, and exit before things go south.

Want to Catch the Next Big Trade in Real Time?

Don’t just read about our wins—witness them live! Join our Q7 Telegram Group where we share real-time trade updates, market insights, and AI-powered strategies as they happen.

Your journey to smarter, faster, and more confident investing starts here.