Imagine this.

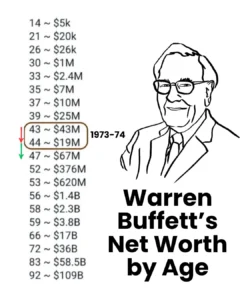

You’re Warren Buffett in 1974. You’re already a seasoned investor with a reputation for spotting undervalued stocks. Your company, Berkshire Hathaway, had built up $43 million in capital. Life was good.

Then, the market tanked.

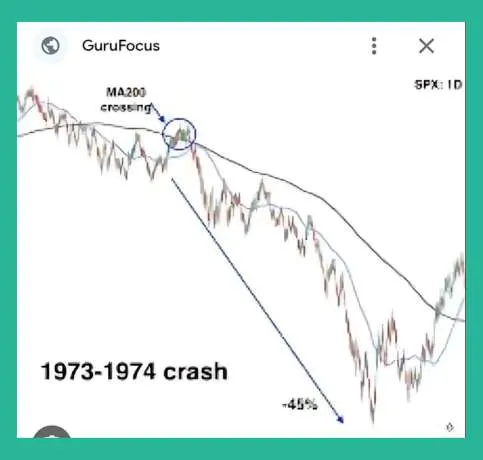

The 1973 oil crisis rocked the global economy. Inflation surged. Interest rates climbed. And Wall Street? It panicked.

In just one year, Buffett’s capital plummeted from $43 million to $19 million — a crushing 60% drop.

Yes, the man we now call the “Oracle of Omaha,” the fifth richest person in the world (with a net worth of $168 billion as of 2024 – source), once sat on the losing end of a market crash. Yet, he didn’t flinch. He didn’t sell out. He didn’t run for the hills.

Instead, he waited.

And what happened next was one of the most legendary comeback stories in financial history.

From Ruin to Riches: A 350% Recovery

By 1977, Buffett’s $19 million had ballooned to $67 million — a staggering 350% return in just three years.

That recovery wasn’t magic. It was patience. It was conviction. It was Buffett’s core investment principle:

This story is not just Buffett’s. It’s a timeless lesson for every investor — especially in India today, where millions of retail investors face market turbulence and emotional decisions.

The Market Always Comes Back

Let’s be honest: seeing your portfolio down by 30%, 40%, or even 50% can feel like the end of the world. But here’s the truth most new investors overlook:

- Market crashes are temporary.

- Market recoveries are inevitable.

Let’s look at a few examples closer to home:

A. 2008 Global Financial Crisis

The Sensex dropped 60% between Jan–Oct 2008. But by late 2010, it was back to its all-time highs.

B. March 2020 COVID Crash

The Indian stock market nosedived by 38%. By Nov 2020, the Nifty 50 had not only recovered — it had grown by more than 70%.

C. Russia–Ukraine War (2022)

A 2,700-point drop in a day? Yes. And yet, FY22 closed with an 18% gain.

Each of these mirrored Buffett’s 1974 moment. And just like Buffett, those who held on — or even better, invested more — came out with massive gains.

What Made Buffett Hold On?

Let’s break down what Buffett did differently — and how you can apply the same strategy to your portfolio.

1. He Knew What He Owned

Buffett wasn’t buying random stocks. He was buying businesses. He once said:

“I buy on the assumption that they could close the market the next day and not reopen it for five years.”

He understood the long-term value of his holdings. When markets dipped, he didn’t see red; he saw discounts.

2. He Ignored the Noise

Newspaper headlines? Economic forecasts? Politicians shouting doom?

Buffett didn’t let them distract him.

This is a direct contradiction to what most retail investors do. We read a few tweets, panic at CNBC tickers, and liquidate. But Buffett did the opposite. He embraced the silence. And trusted his research.

3. He Bought More During the Fall

In times of fear, Buffett didn’t just sit. He invested more. His famous quote rings true here:

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

When his own portfolio was down 60%, he doubled down on what he believed in.

How Buffett’s Crash Mirrors Today’s Investor Pain

Fast forward to today — a time when thousands of Indian investors are sitting with portfolios down 30–50% on paper. Are you one of them? Then you’re exactly where Buffett was in 1974. And just like him, you have a choice:

- Sell now and lock in losses, Or

- Hold (and even accumulate), knowing that recoveries happen — always.

If you think the market won’t bounce back, history says you’re wrong. We published a detailed blog on “Stock Market Bounce Back: 5 Epic Crash-and-Recovery Stories“.

Buffett’s Secret Weapon: Time

Here’s the ultimate truth: Buffett didn’t get rich from timing the market. He got rich by time in the market. At 94, he’s been investing for over 80 years, having bought his first stock at age 11. According to Visual Capitalist, 99% of his net worth came after his 50th birthday.

Think about that. His real wealth came not from short-term wins, but from long-term compounding.

What You Can Do Today

If your portfolio is bleeding, here’s your action plan — Buffett style:

- Don’t panic.

- Review what you own. Are they quality businesses? Then hold.

- Have cash? Consider accumulating more.

- Stop checking prices every 5 minutes. Markets recover — they always do.

- Play the long game. Let compounding do its magic.

And most importantly, remind yourself of Buffett’s 1974 crash. Even the greatest investor alive went through a 60% drawdown — and came back stronger. You can too.

Be Your Own Buffett

There’s a Warren Buffett in every long-term investor — someone who ignores the noise, thinks like a business owner, and sees a crash as a buying opportunity, not a death sentence.

Buffett’s 1974 story isn’t just a history lesson. It’s a wake-up call. So the next time your portfolio shows red, smile — you might just be at the start of your own 350% rebound.