Monday, 7th April 2025.

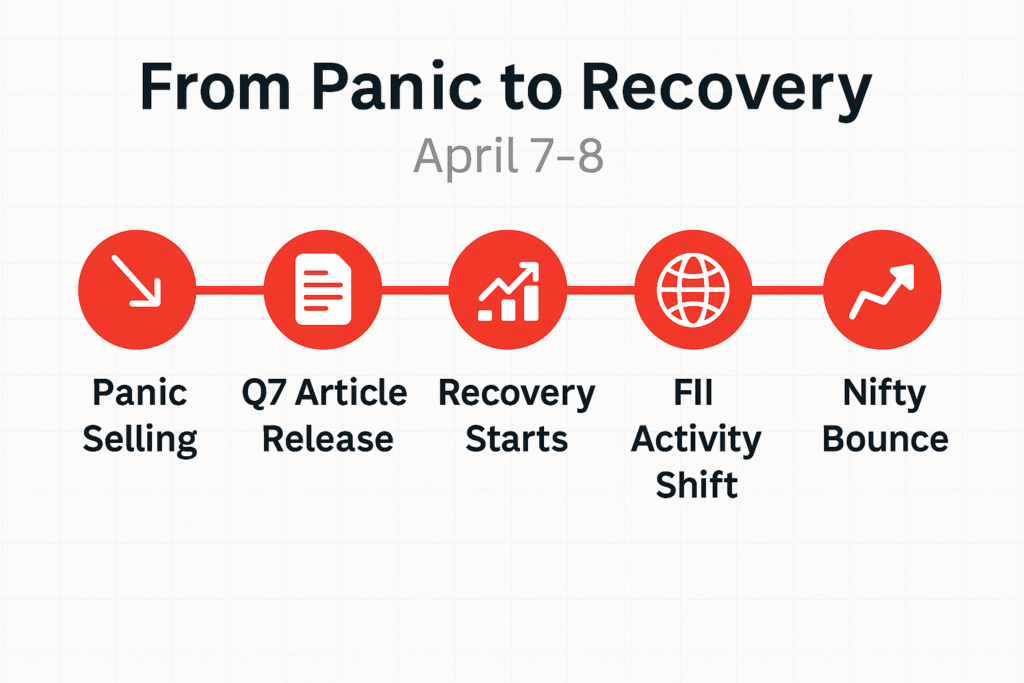

For most traders, it will be remembered as Black Monday—a day filled with fear, panic, and confusion. The market that had shown signs of recovery in late March suddenly turned its head again and plunged sharply, wiping out recent gains. Financial influencers on social media screamed doom. Telegram groups buzzed with nervous chatter. Panic selling swept across retail portfolios.

But while millions gave in to the fear…

Q7 stood calm. In fact, we saw an opportunity.

And we didn’t just see it—we called it.

In short, we said this was not the end, but the beginning.

While the world gave in to fear, our clients held on—strong, calm, and focused.

Part 1: When Everyone Was Panicking, Q7 Was Preparing

While the markets were painting screens red, our AI-powered trading algorithm was analyzing the real story behind the fear. We published a bold article titled:

“This Is Not the End of the Market—It’s Just the Beginning of a Big Opportunity”

We explained the truth, backed by logic:

-

The tariff imposed by the US impacted only 2% of India’s GDP. The media noise was louder than the actual risk.

-

India’s strength lies in domestic demand, unlike export-heavy economies.

-

Falling crude prices were easing our current account deficit.

-

The country’s fiscal health, foreign exchange reserves, and corporate debt exposure were at their best in years.

-

And most importantly—our algorithm had picked up signs of an upward reversal, not further collapse.

Part 2: The Turning Point – April 8th, 2025

The very next day, the market did something spectacular. Nifty recovered 1000 points in a single day. The same people who called it a “Black Monday” were now speechless.

Our clients? They smiled. They had already taken positions based on our AI’s logic-driven analysis. They didn’t just survive the panic—they profited from it.

And on that day, we issued another update:

“Why This Sell-Off Will Become a Turning Point for India’s Growth Story”

We explained how these volatile moments are gifts in disguise, and how the long-term bull market had just reloaded. Our algorithm was not just reacting—it was leading.

Part 3: The Power of Data-Driven Decisions

This wasn’t luck. This was data meeting discipline.

Here’s what made the difference:

-

No Emotions, Only Execution: Our AI is immune to fear, greed, or herd mentality.

-

24/7 Monitoring: It scans over 200+ data points across macro indicators, price action, volume surges, global sentiment, and institutional behavior.

-

Pattern Recognition: It knows the difference between noise and signal. It had already seen similar patterns in 2008, 2020, and late 2022.

-

Custom Risk Management: Even in volatile conditions, the algorithm adjusts position sizes, exits non-performing trades, and protects capital.

Most traders followed their emotions. Q7 followed logic. That’s the difference between reaction and strategy.

We didn’t predict the future. Our Algo understood it. When chaos reigned, we relied on truth, data, and discipline. We empowered traders with confidence and clarity. And that’s what heroes do. They don’t run from the storm—they walk through it.

Real People, Real Impact

Here’s what a few of our clients shared:

The AI doesn’t get scared. That’s the best part. I had faith in the system and it paid off big!

Raj, Options Trader, Bengaluru

Had I followed the crowd, I would have booked losses. Q7’s update gave me clarity and confidence to hold. Next day’s bounce felt like magic!

Priya, Retail Trader, Pune

This case study is not just a celebration of a great market call. It’s a reminder to every Indian trader:

When fear is loud, let logic be louder.

When markets fall, let your mindset rise.

When others panic, you prepare.

This is the mindset of a successful trader. And if you have it, no storm can stop you.