The recent release of US job data has garnered attention worldwide, especially in emerging markets like India. The health of the US economy, as reflected in its employment figures, has a ripple effect on global financial markets, including the Indian stock market. In this article, we explore how the latest US employment figures are influencing the Indian stock market and what investors can anticipate in the short and long term.

US Job Data: A Mixed Economic Picture

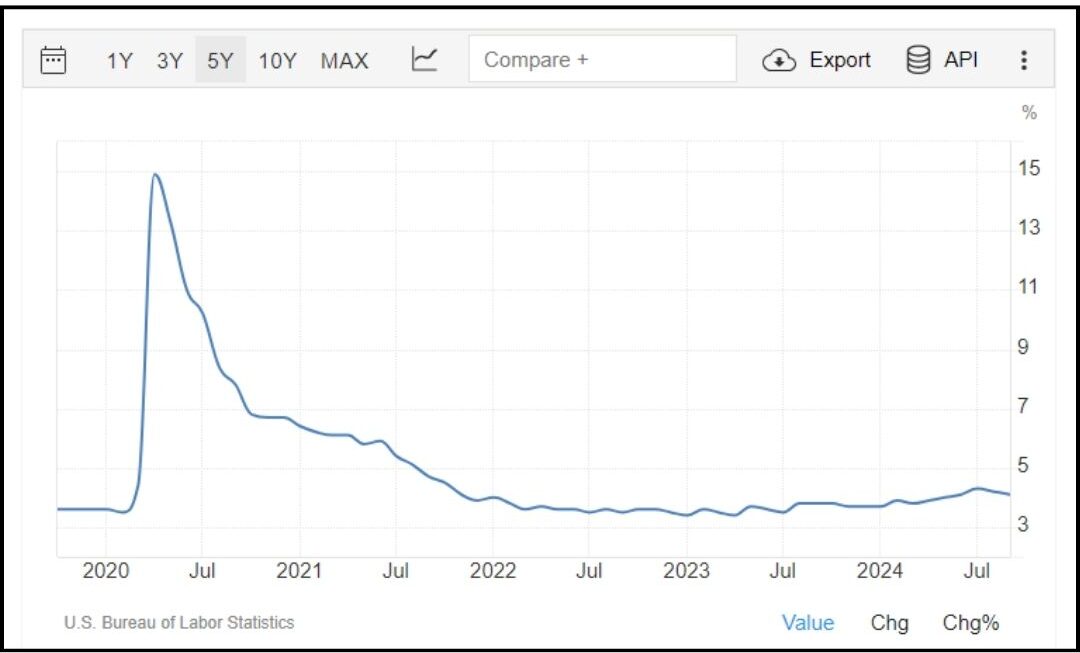

The US Labor Department’s latest employment report shows a complex economic landscape. While fewer jobs were added than expected, the unemployment rate stayed steady, and wages saw modest growth. This mixed data suggests that while the US economy is expanding, it may be slowing down, raising questions about the Federal Reserve’s future monetary policy.

For global investors, particularly those in India, any shift in US economic policy can have substantial effects. Here’s how the latest US job data is impacting the Indian stock market.

Impact on the Indian Stock Market

- Volatility in IT and Tech StocksIndia’s IT sector is highly sensitive to US economic performance. Major Indian IT companies like Infosys, TCS, and Wipro depend on the US for a significant portion of their revenue. A potential slowdown in the US economy could signal reduced IT spending by American clients, directly affecting the earnings of Indian IT firms.

Following the release of the US job data, volatility was observed in these stocks as investors reassessed future earnings prospects. The IT sector remains one of the most vulnerable to shifts in the US economy.

- Currency FluctuationsThe Indian Rupee tends to fluctuate in response to US economic data, particularly against the US Dollar. Speculation about whether the Federal Reserve will continue its interest rate hikes or take a pause after the latest job figures has already affected currency markets.

Any signal of continued rate hikes typically strengthens the Dollar, weakening the Rupee in the process. A weaker Rupee could lead to foreign investor outflows from Indian equity markets, triggering further stock market volatility. Investors should pay close attention to US Fed announcements and their potential effect on exchange rates.

- Global Sentiment and Risk AppetiteUS job data also influences global risk sentiment. During periods of economic uncertainty in the US, investors may shift towards a risk-averse strategy, pulling capital from emerging markets like India. This trend could lead to foreign institutional investor (FII) sell-offs in sectors heavily dependent on global investment, such as financial services and consumer goods.When US job data suggests an economic slowdown, global investors often look to reduce exposure in emerging markets, increasing pressure on Indian equities.

Medium to Long-Term Implications for Indian Stocks

- Federal Reserve Policy and Its Ripple EffectThe Federal Reserve’s reaction to the latest job data will play a critical role in shaping the future of the Indian stock market. If the Fed decides to slow down or halt rate hikes, it could stabilize the market outlook, weakening the US Dollar and strengthening the Indian Rupee. This scenario could attract more foreign investment into Indian equities, providing much-needed relief to sectors affected by global headwinds.

- Sector-Specific ImpactsWhile the Indian IT sector may face volatility, other sectors could remain resilient. Pharmaceuticals and consumer staples, which are less sensitive to US economic fluctuations, may offer more stable returns during this period. Investors might look to these defensive sectors as safer bets amid the uncertainty stemming from global economic data.

- The Role of Domestic FactorsWhile US economic data is influential, domestic factors still play a significant role in driving the Indian stock market. Corporate earnings, inflation figures, and government policies will continue to shape market dynamics. A strong domestic economy can buffer against some of the negative effects of global economic slowdowns, offering a degree of protection for investors.

Long-Term Outlook: What Should Indian Investors Expect?

The recent US job data has certainly injected some volatility into the Indian stock market, but the long-term impact will largely hinge on how the Federal Reserve adjusts its monetary policy. For Indian investors, keeping a close watch on both global and domestic economic indicators is essential.

Key Takeaways:

- Diversify your portfolio by considering sectors less affected by global volatility, such as pharmaceuticals and consumer goods.

- Monitor US Federal Reserve announcements and their effect on currency rates, as these could influence foreign investment flows.

- Stay informed about domestic economic indicators like corporate earnings and inflation, which could offset the effects of unfavorable global data.

Conclusion: Navigating Uncertainty with a Strategic Approach

The US job data may have introduced short-term volatility into the Indian stock market, but by staying informed and making strategic investment decisions, investors can navigate these turbulent times. Focusing on sectors less vulnerable to global economic shifts and keeping a close eye on the Federal Reserve’s policies will be crucial for minimizing risk and maximizing returns.

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Investors are encouraged to perform their own analysis and seek professional guidance before making investment decisions.

Q7 Trading Solutions pioneers in algorithmic trading with tailored strategies for Stock options and Index options. Harnessing the power of AI and Big Data, we deliver precision in technical analysis using statistics & mathematical modeling, providing a reliable path to optimize trading outcomes. You can learn more about its prowess by joining our 28k+ strong community absolutely for FREE.